flashier_stocks

Matthew Stephens

2021-05-22

Last updated: 2021-05-22

Checks: 7 0

Knit directory: misc/analysis/

This reproducible R Markdown analysis was created with workflowr (version 1.6.2). The Checks tab describes the reproducibility checks that were applied when the results were created. The Past versions tab lists the development history.

Great! Since the R Markdown file has been committed to the Git repository, you know the exact version of the code that produced these results.

Great job! The global environment was empty. Objects defined in the global environment can affect the analysis in your R Markdown file in unknown ways. For reproduciblity it’s best to always run the code in an empty environment.

The command set.seed(1) was run prior to running the code in the R Markdown file. Setting a seed ensures that any results that rely on randomness, e.g. subsampling or permutations, are reproducible.

Great job! Recording the operating system, R version, and package versions is critical for reproducibility.

Nice! There were no cached chunks for this analysis, so you can be confident that you successfully produced the results during this run.

Great job! Using relative paths to the files within your workflowr project makes it easier to run your code on other machines.

Great! You are using Git for version control. Tracking code development and connecting the code version to the results is critical for reproducibility.

The results in this page were generated with repository version 083b740. See the Past versions tab to see a history of the changes made to the R Markdown and HTML files.

Note that you need to be careful to ensure that all relevant files for the analysis have been committed to Git prior to generating the results (you can use wflow_publish or wflow_git_commit). workflowr only checks the R Markdown file, but you know if there are other scripts or data files that it depends on. Below is the status of the Git repository when the results were generated:

Ignored files:

Ignored: .DS_Store

Ignored: .Rhistory

Ignored: .Rproj.user/

Ignored: analysis/.RData

Ignored: analysis/.Rhistory

Ignored: analysis/ALStruct_cache/

Ignored: data/.Rhistory

Ignored: data/pbmc/

Untracked files:

Untracked: .dropbox

Untracked: Icon

Untracked: analysis/GHstan.Rmd

Untracked: analysis/GTEX-cogaps.Rmd

Untracked: analysis/PACS.Rmd

Untracked: analysis/Rplot.png

Untracked: analysis/SPCAvRP.rmd

Untracked: analysis/admm_02.Rmd

Untracked: analysis/admm_03.Rmd

Untracked: analysis/compare-transformed-models.Rmd

Untracked: analysis/cormotif.Rmd

Untracked: analysis/cp_ash.Rmd

Untracked: analysis/eQTL.perm.rand.pdf

Untracked: analysis/eb_prepilot.Rmd

Untracked: analysis/eb_var.Rmd

Untracked: analysis/ebpmf1.Rmd

Untracked: analysis/flash_test_tree.Rmd

Untracked: analysis/flash_tree.Rmd

Untracked: analysis/ieQTL.perm.rand.pdf

Untracked: analysis/lasso_em_03.Rmd

Untracked: analysis/m6amash.Rmd

Untracked: analysis/mash_bhat_z.Rmd

Untracked: analysis/mash_ieqtl_permutations.Rmd

Untracked: analysis/mixsqp.Rmd

Untracked: analysis/mr.ash_lasso_init.Rmd

Untracked: analysis/mr.mash.test.Rmd

Untracked: analysis/mr_ash_modular.Rmd

Untracked: analysis/mr_ash_parameterization.Rmd

Untracked: analysis/mr_ash_ridge.Rmd

Untracked: analysis/mv_gaussian_message_passing.Rmd

Untracked: analysis/nejm.Rmd

Untracked: analysis/nmf_bg.Rmd

Untracked: analysis/normal_conditional_on_r2.Rmd

Untracked: analysis/normalize.Rmd

Untracked: analysis/pbmc.Rmd

Untracked: analysis/poisson_transform.Rmd

Untracked: analysis/pseudodata.Rmd

Untracked: analysis/qrnotes.txt

Untracked: analysis/ridge_iterative_02.Rmd

Untracked: analysis/ridge_iterative_splitting.Rmd

Untracked: analysis/samps/

Untracked: analysis/sc_bimodal.Rmd

Untracked: analysis/shrinkage_comparisons_changepoints.Rmd

Untracked: analysis/susie_en.Rmd

Untracked: analysis/susie_z_investigate.Rmd

Untracked: analysis/svd-timing.Rmd

Untracked: analysis/temp.RDS

Untracked: analysis/temp.Rmd

Untracked: analysis/test-figure/

Untracked: analysis/test.Rmd

Untracked: analysis/test.Rpres

Untracked: analysis/test.md

Untracked: analysis/test_qr.R

Untracked: analysis/test_sparse.Rmd

Untracked: analysis/z.txt

Untracked: code/multivariate_testfuncs.R

Untracked: code/rqb.hacked.R

Untracked: data/4matthew/

Untracked: data/4matthew2/

Untracked: data/E-MTAB-2805.processed.1/

Untracked: data/ENSG00000156738.Sim_Y2.RDS

Untracked: data/GDS5363_full.soft.gz

Untracked: data/GSE41265_allGenesTPM.txt

Untracked: data/Muscle_Skeletal.ACTN3.pm1Mb.RDS

Untracked: data/Thyroid.FMO2.pm1Mb.RDS

Untracked: data/bmass.HaemgenRBC2016.MAF01.Vs2.MergedDataSources.200kRanSubset.ChrBPMAFMarkerZScores.vs1.txt.gz

Untracked: data/bmass.HaemgenRBC2016.Vs2.NewSNPs.ZScores.hclust.vs1.txt

Untracked: data/bmass.HaemgenRBC2016.Vs2.PreviousSNPs.ZScores.hclust.vs1.txt

Untracked: data/eb_prepilot/

Untracked: data/finemap_data/fmo2.sim/b.txt

Untracked: data/finemap_data/fmo2.sim/dap_out.txt

Untracked: data/finemap_data/fmo2.sim/dap_out2.txt

Untracked: data/finemap_data/fmo2.sim/dap_out2_snp.txt

Untracked: data/finemap_data/fmo2.sim/dap_out_snp.txt

Untracked: data/finemap_data/fmo2.sim/data

Untracked: data/finemap_data/fmo2.sim/fmo2.sim.config

Untracked: data/finemap_data/fmo2.sim/fmo2.sim.k

Untracked: data/finemap_data/fmo2.sim/fmo2.sim.k4.config

Untracked: data/finemap_data/fmo2.sim/fmo2.sim.k4.snp

Untracked: data/finemap_data/fmo2.sim/fmo2.sim.ld

Untracked: data/finemap_data/fmo2.sim/fmo2.sim.snp

Untracked: data/finemap_data/fmo2.sim/fmo2.sim.z

Untracked: data/finemap_data/fmo2.sim/pos.txt

Untracked: data/logm.csv

Untracked: data/m.cd.RDS

Untracked: data/m.cdu.old.RDS

Untracked: data/m.new.cd.RDS

Untracked: data/m.old.cd.RDS

Untracked: data/mainbib.bib.old

Untracked: data/mat.csv

Untracked: data/mat.txt

Untracked: data/mat_new.csv

Untracked: data/matrix_lik.rds

Untracked: data/paintor_data/

Untracked: data/prices.csv

Untracked: data/running_data_chris.csv

Untracked: data/running_data_matthew.csv

Untracked: data/temp.txt

Untracked: data/y.txt

Untracked: data/y_f.txt

Untracked: data/zscore_jointLCLs_m6AQTLs_susie_eQTLpruned.rds

Untracked: data/zscore_jointLCLs_random.rds

Untracked: explore_udi.R

Untracked: output/fit.k10.rds

Untracked: output/fit.varbvs.RDS

Untracked: output/glmnet.fit.RDS

Untracked: output/test.bv.txt

Untracked: output/test.gamma.txt

Untracked: output/test.hyp.txt

Untracked: output/test.log.txt

Untracked: output/test.param.txt

Untracked: output/test2.bv.txt

Untracked: output/test2.gamma.txt

Untracked: output/test2.hyp.txt

Untracked: output/test2.log.txt

Untracked: output/test2.param.txt

Untracked: output/test3.bv.txt

Untracked: output/test3.gamma.txt

Untracked: output/test3.hyp.txt

Untracked: output/test3.log.txt

Untracked: output/test3.param.txt

Untracked: output/test4.bv.txt

Untracked: output/test4.gamma.txt

Untracked: output/test4.hyp.txt

Untracked: output/test4.log.txt

Untracked: output/test4.param.txt

Untracked: output/test5.bv.txt

Untracked: output/test5.gamma.txt

Untracked: output/test5.hyp.txt

Untracked: output/test5.log.txt

Untracked: output/test5.param.txt

Note that any generated files, e.g. HTML, png, CSS, etc., are not included in this status report because it is ok for generated content to have uncommitted changes.

These are the previous versions of the repository in which changes were made to the R Markdown (analysis/flashier_stocks.Rmd) and HTML (docs/flashier_stocks.html) files. If you’ve configured a remote Git repository (see ?wflow_git_remote), click on the hyperlinks in the table below to view the files as they were in that past version.

| File | Version | Author | Date | Message |

|---|---|---|---|---|

| Rmd | 083b740 | Matthew Stephens | 2021-05-22 | ../data/prices.csv |

Introduction

In preparing homework for my class I ran flashier on some stock data. (Note that flash errored out here, and in any case flashier was quite a bit faster…) It got me thinking about appropriate application of flash/flashier for time series, so I’m reporting the results here.

The data were downloaded as in https://stephens999.github.io/stat34800/stocks.html We probably could do with looking at a bigger dataset if we want to take this seriously, but I do that for now.

# AAPL: Apple

# NFLX: Netflix

# AMZN: Amazon

# MMM: 3M

# K: Kellogs

# O: Realty Income Corp

# NSRGY: Nestle

# LDSVF: Lindt

# JPM: JP Morgan Chase

# JNJ: Johnson and Johnson

# TSLA: Tesla

# V: Visa

# PFE: Pfizerprices = read.csv("../data/prices.csv")

log_prices = log(prices)

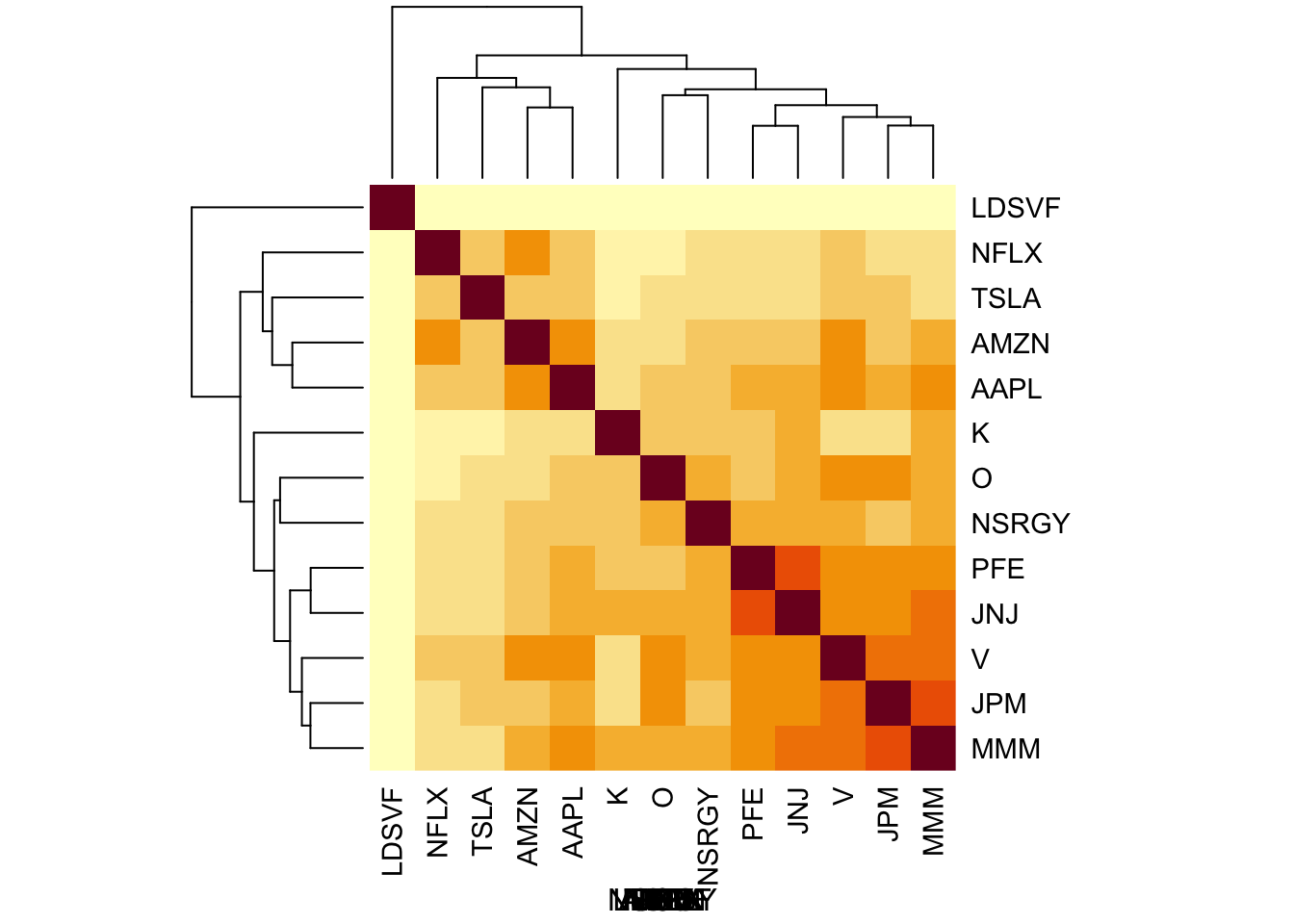

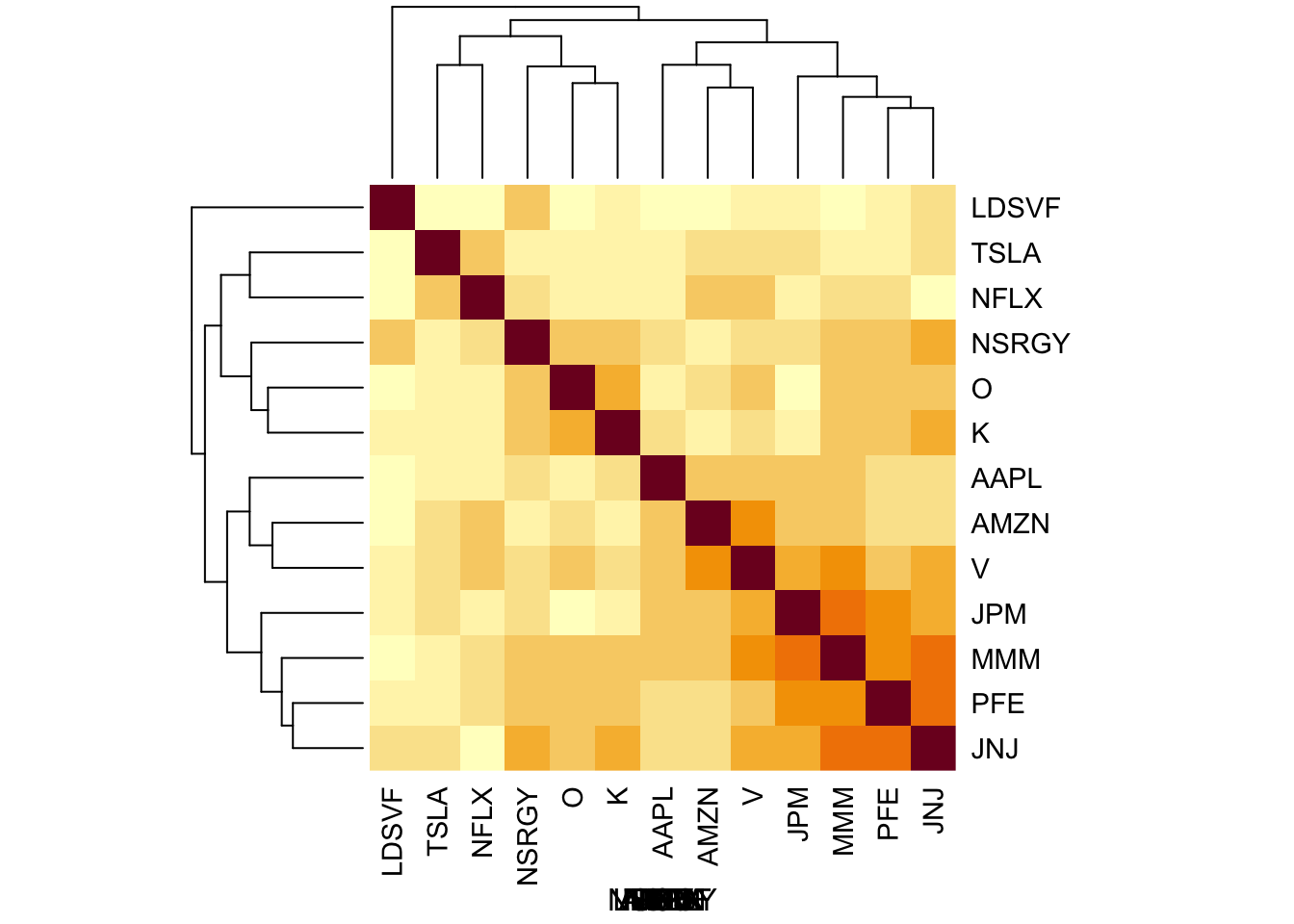

log_returns = apply(log_prices,2, diff)You can see some structure in the correlation matrix: the tech companys are correlated, as are the PFE/JNJ and the financial companies (V,JPM).

S = cor(log_returns)

heatmap(S, xlab = names(prices), symm=TRUE)

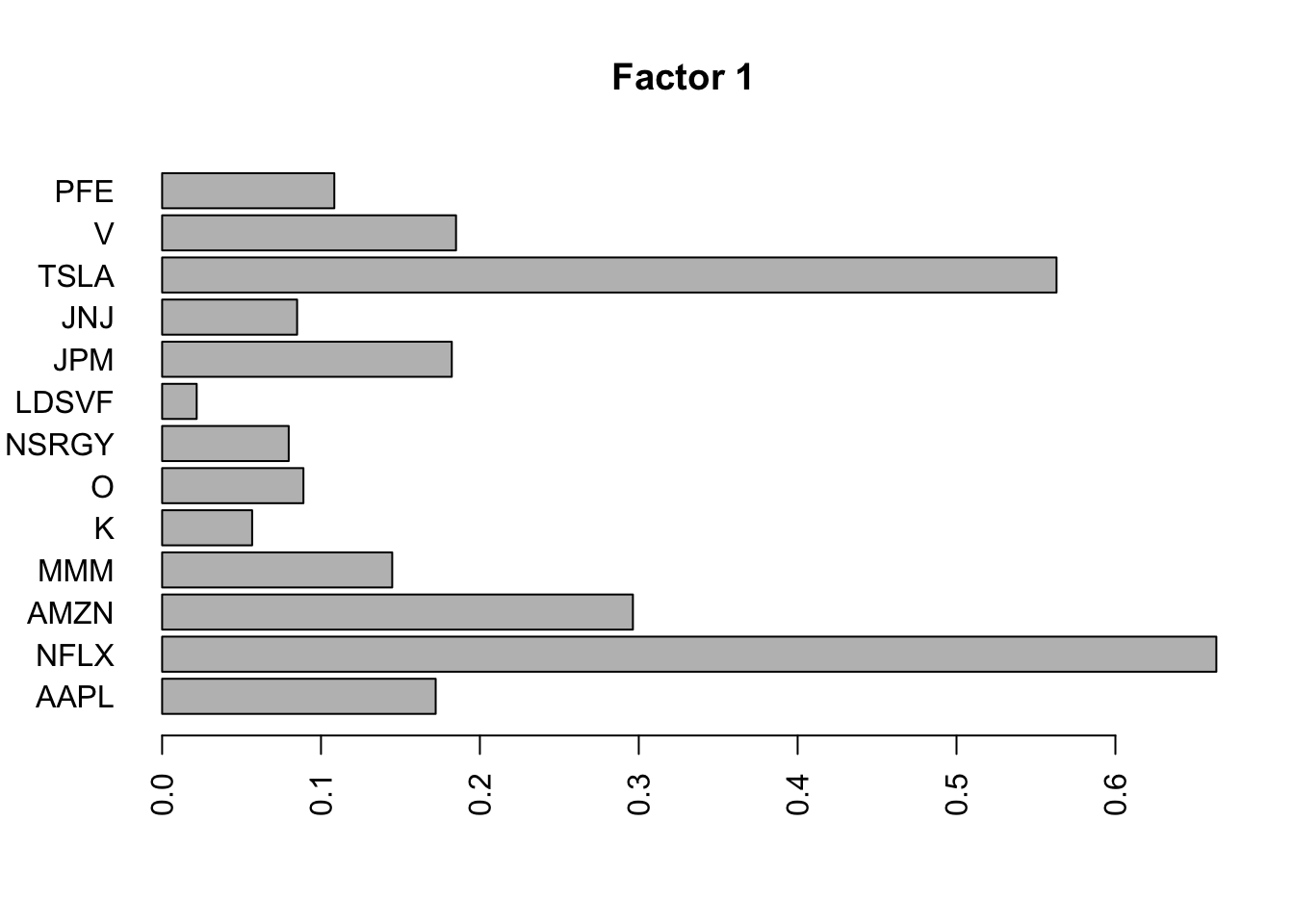

Flashier on the raw data

Note I use column-specific variances. I found backfitting really increases the sparsity in this case (particularly in the time dimension).

#library("flashr")

library("ebnm")

library("flashier")

#fit.f = flashr::flash(as.matrix(log_prices),ebnm_fn = "ebnm_pl") ## errors out

fit.f = flashier::flash(as.matrix(log_prices),prior.family = prior.point.laplace(), var.type = 2, backfit = TRUE)Adding factor 1 to flash object...

Adding factor 2 to flash object...

Adding factor 3 to flash object...

Adding factor 4 to flash object...

Adding factor 5 to flash object...

Adding factor 6 to flash object...

Adding factor 7 to flash object...

Adding factor 8 to flash object...

Adding factor 9 to flash object...

Factor doesn't significantly increase objective and won't be added.

Wrapping up...

Done.

Backfitting 8 factors (tolerance: 5.17e-04)...

Difference between iterations is within 1.0e+03...

Difference between iterations is within 1.0e+02...

Difference between iterations is within 1.0e+01...

Difference between iterations is within 1.0e+00...

Difference between iterations is within 1.0e-01...

Difference between iterations is within 1.0e-02...

Difference between iterations is within 1.0e-03...

Wrapping up...

Done.

Nullchecking 8 factors...

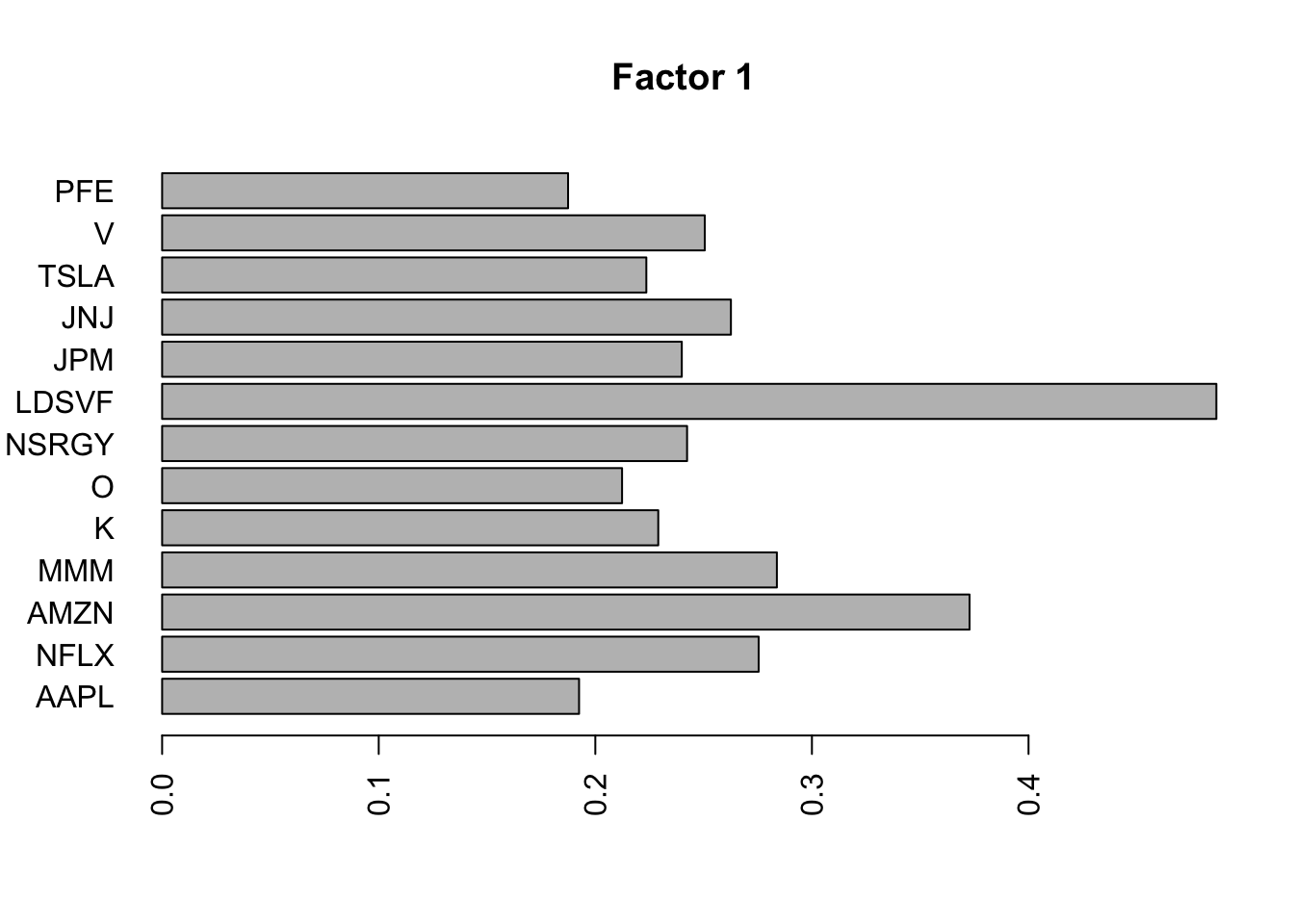

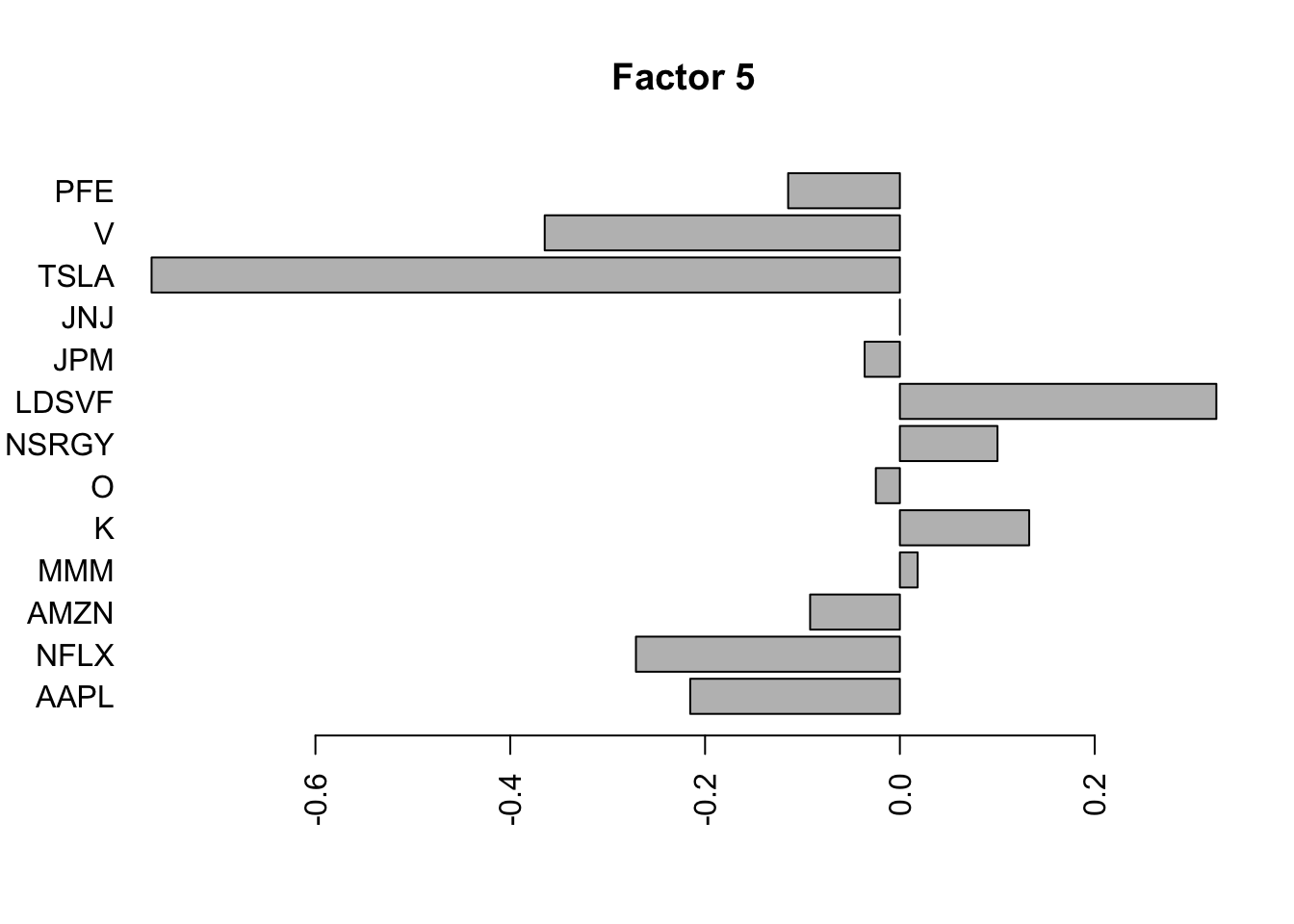

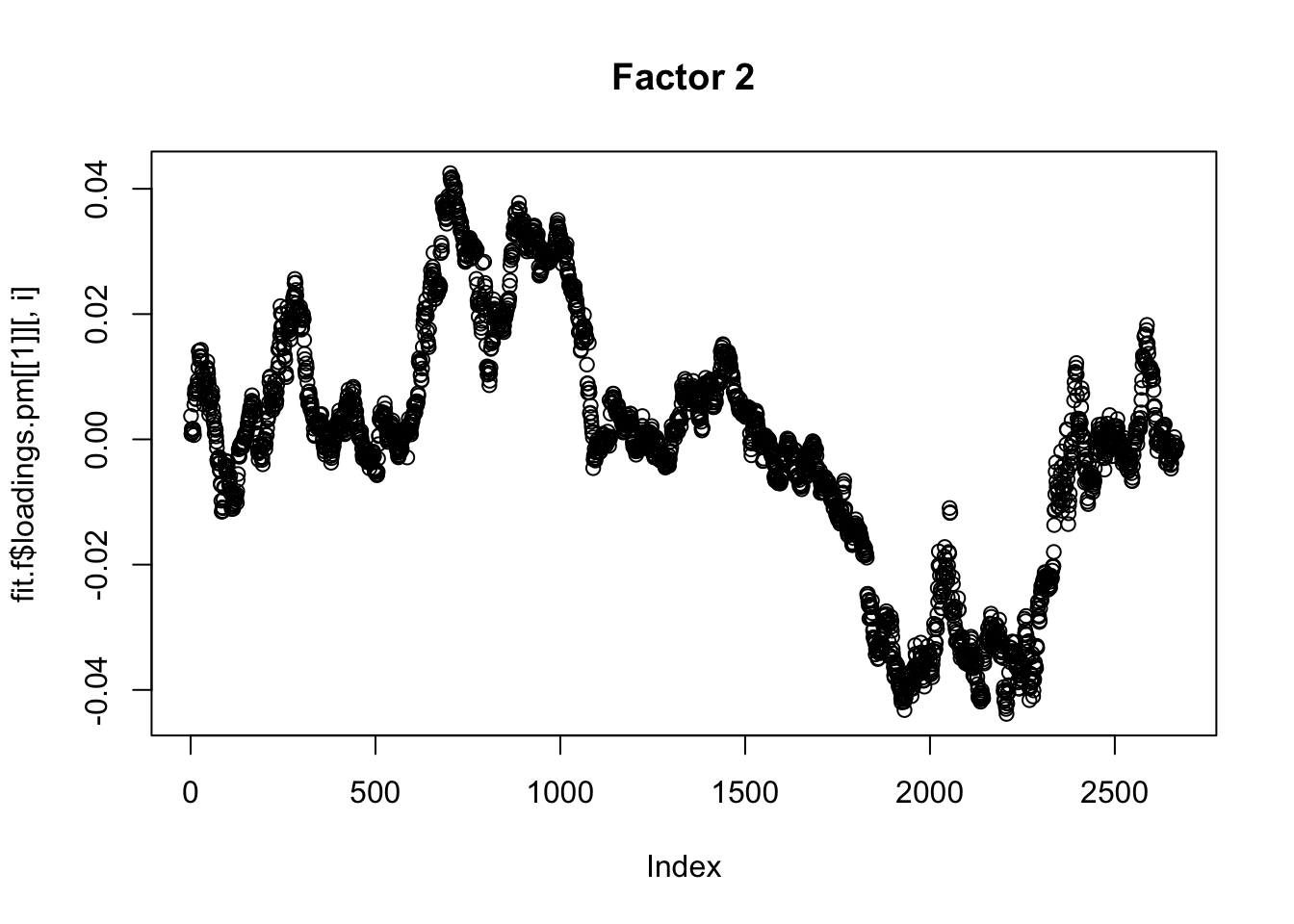

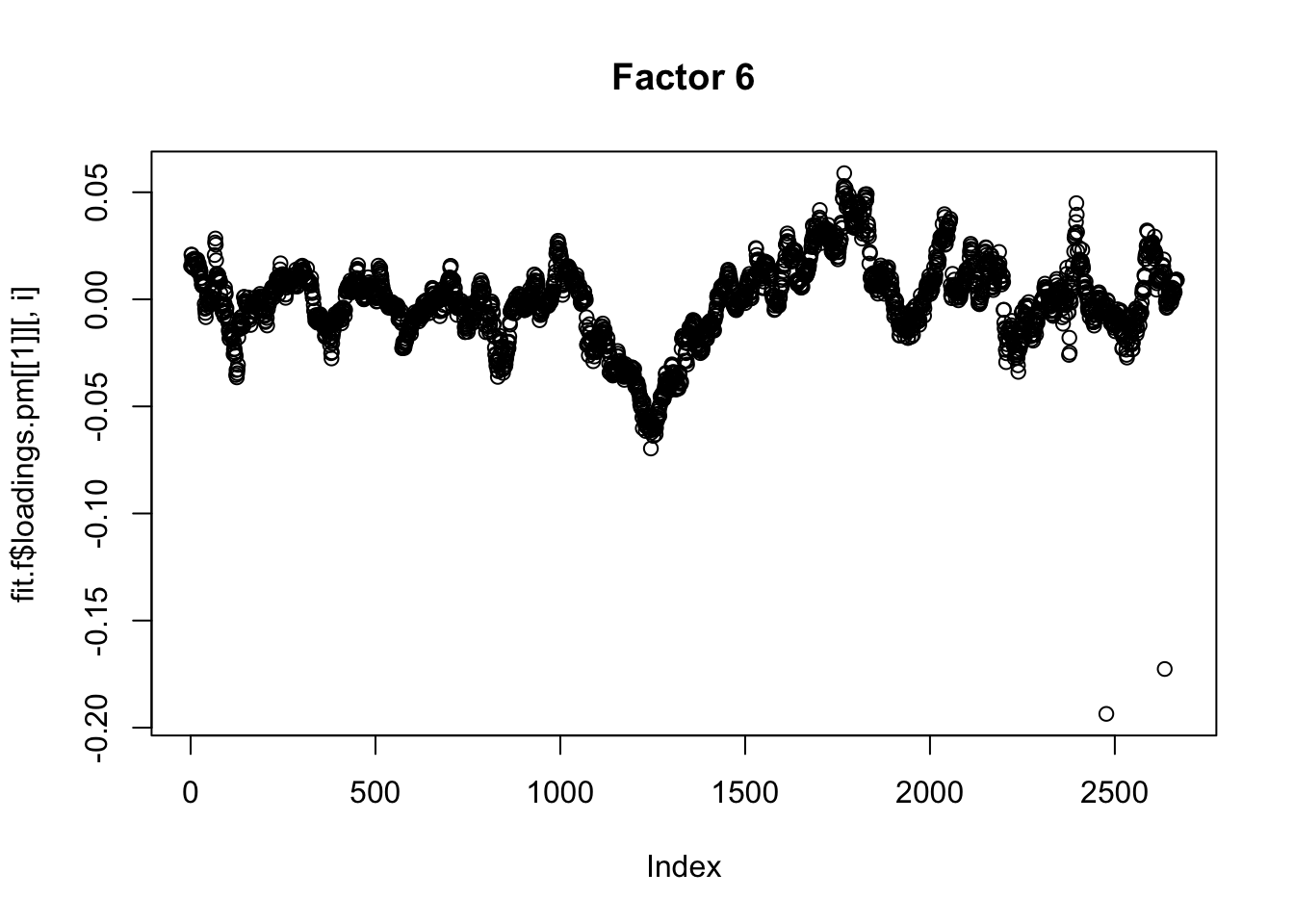

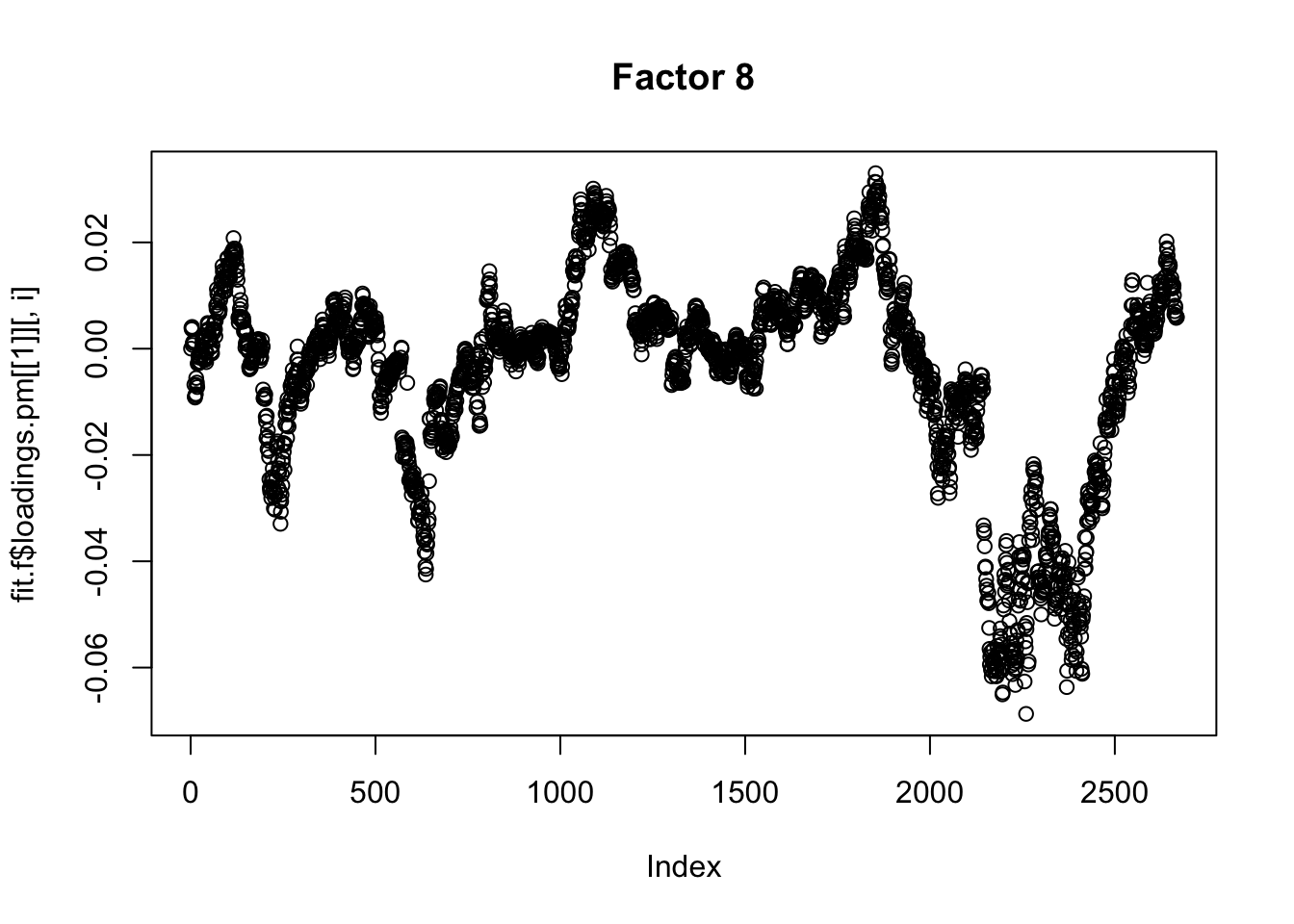

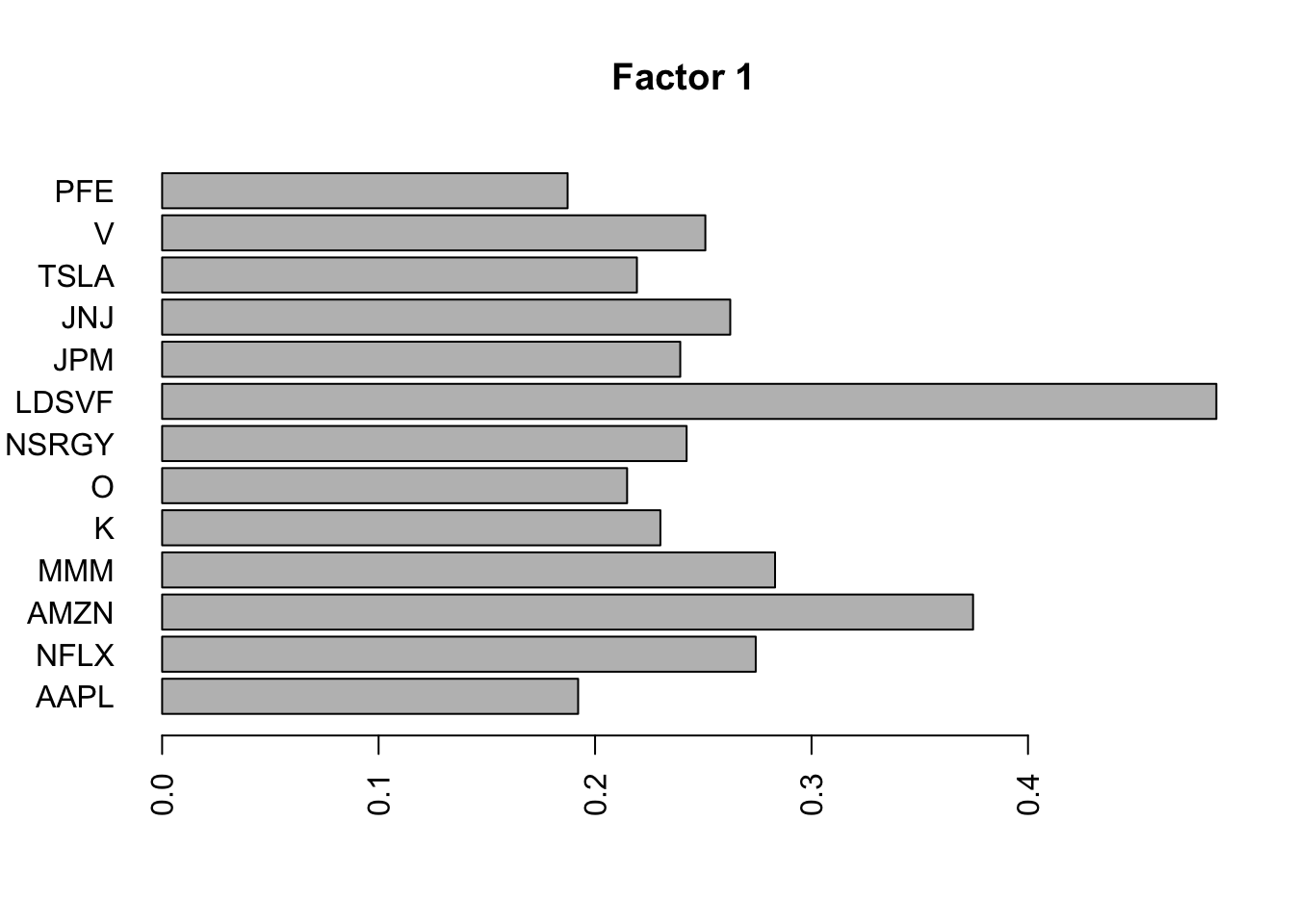

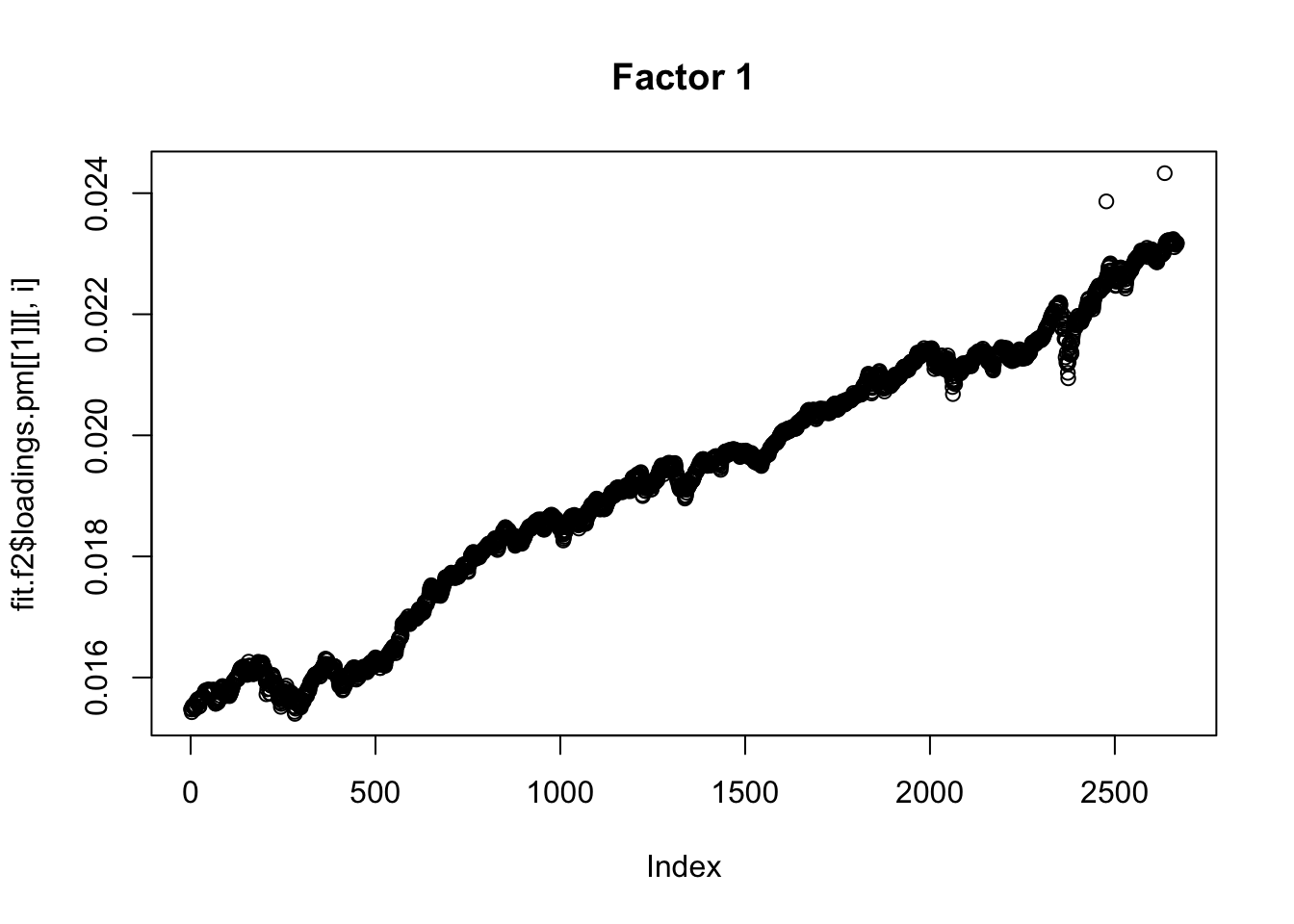

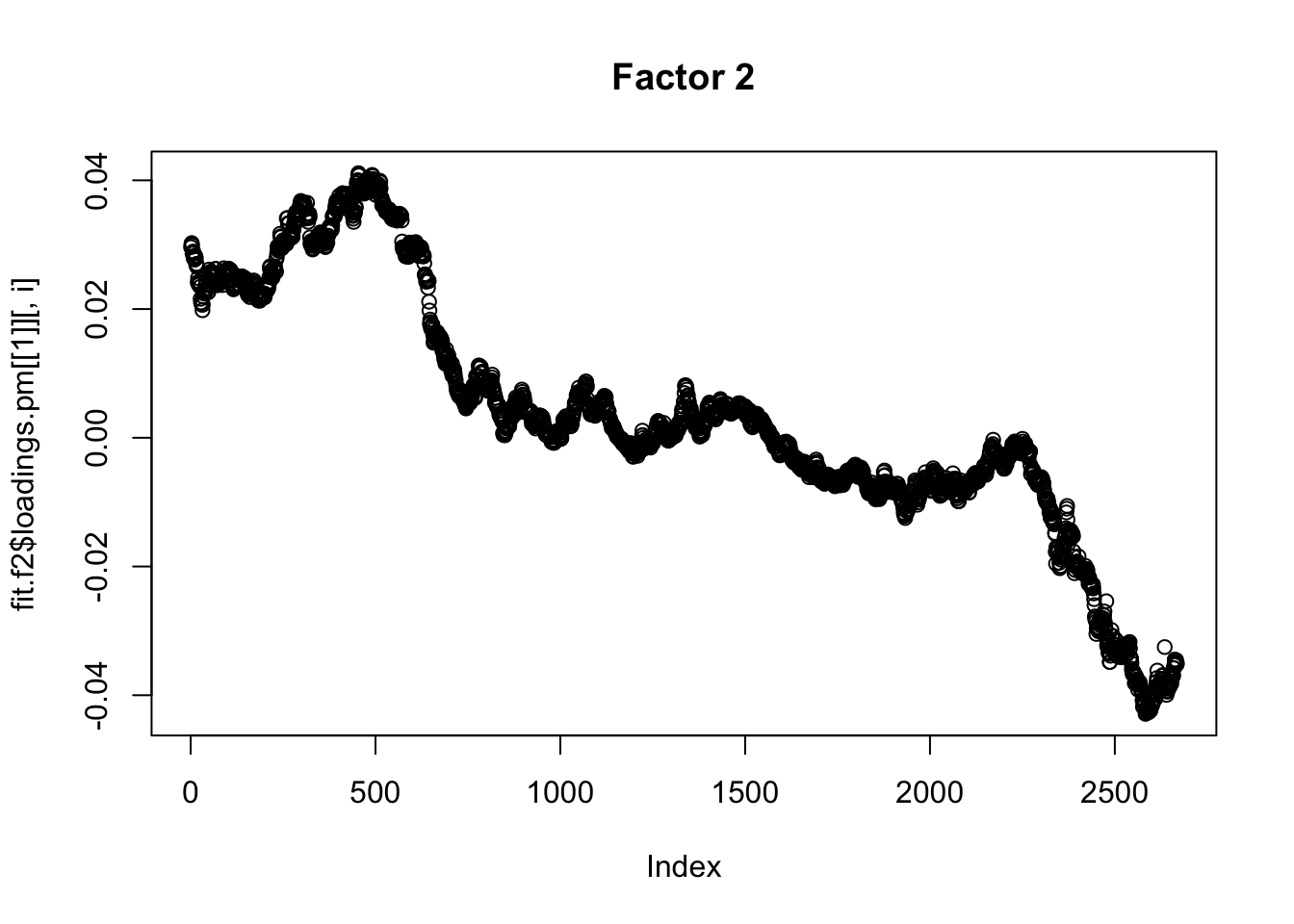

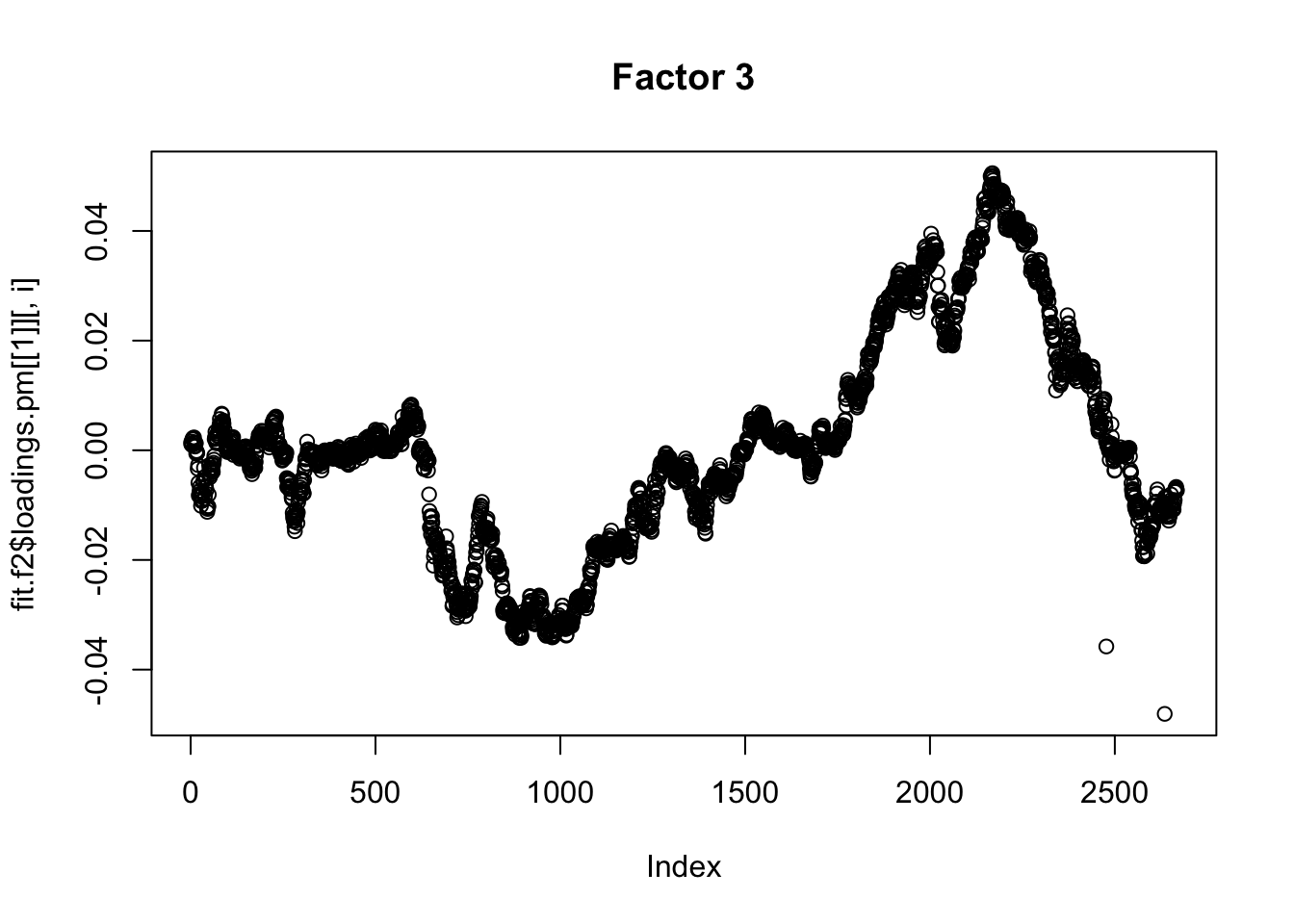

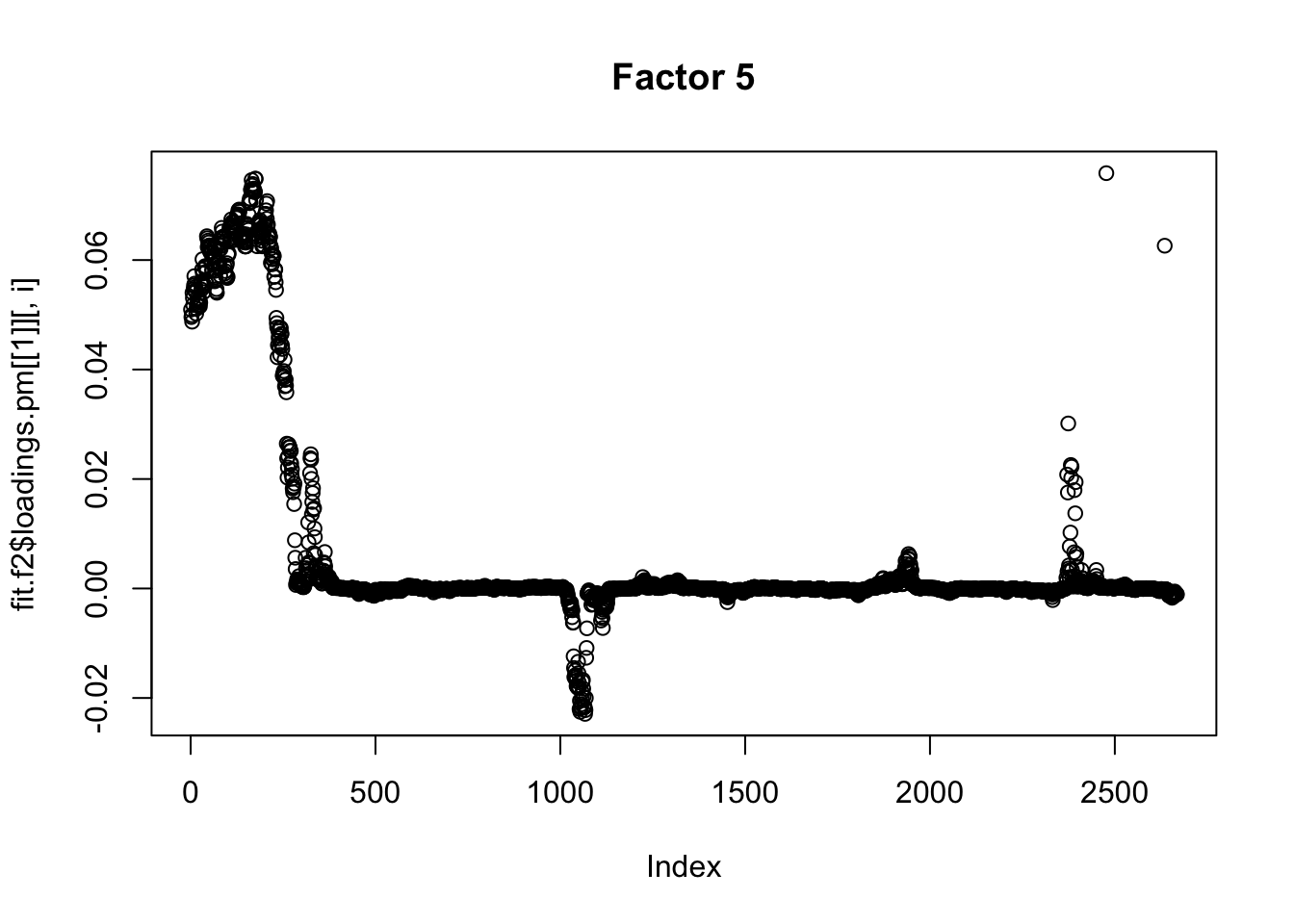

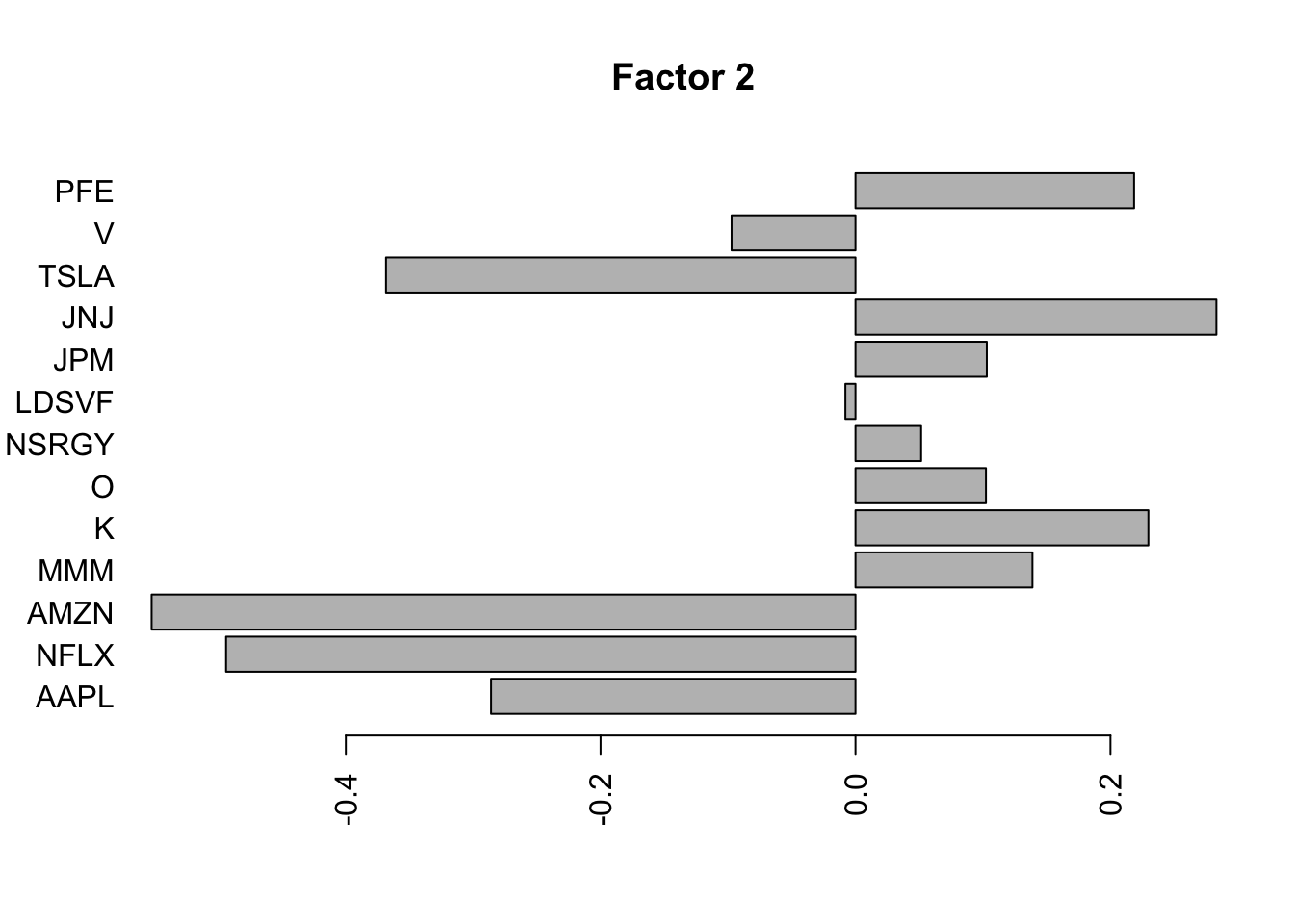

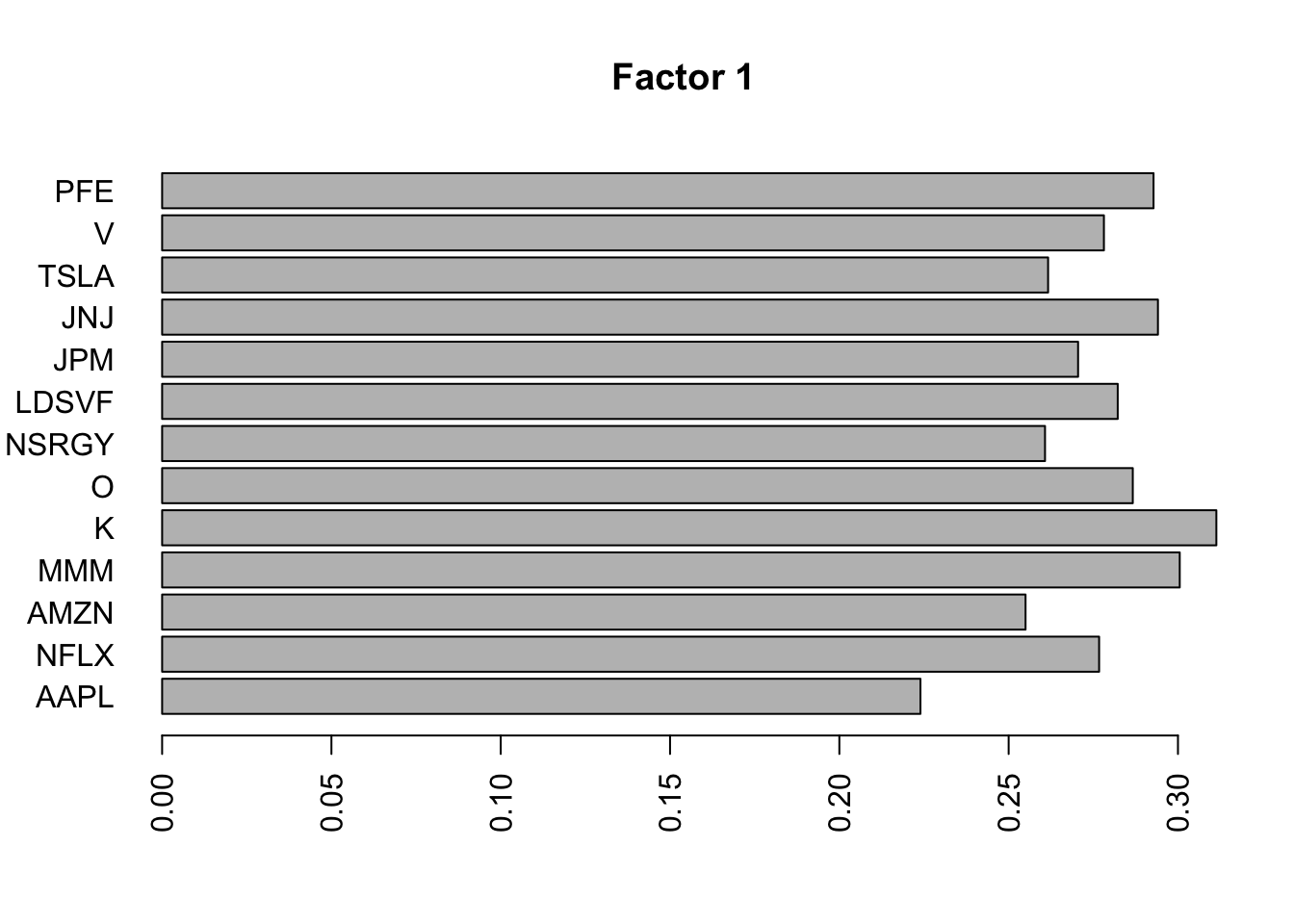

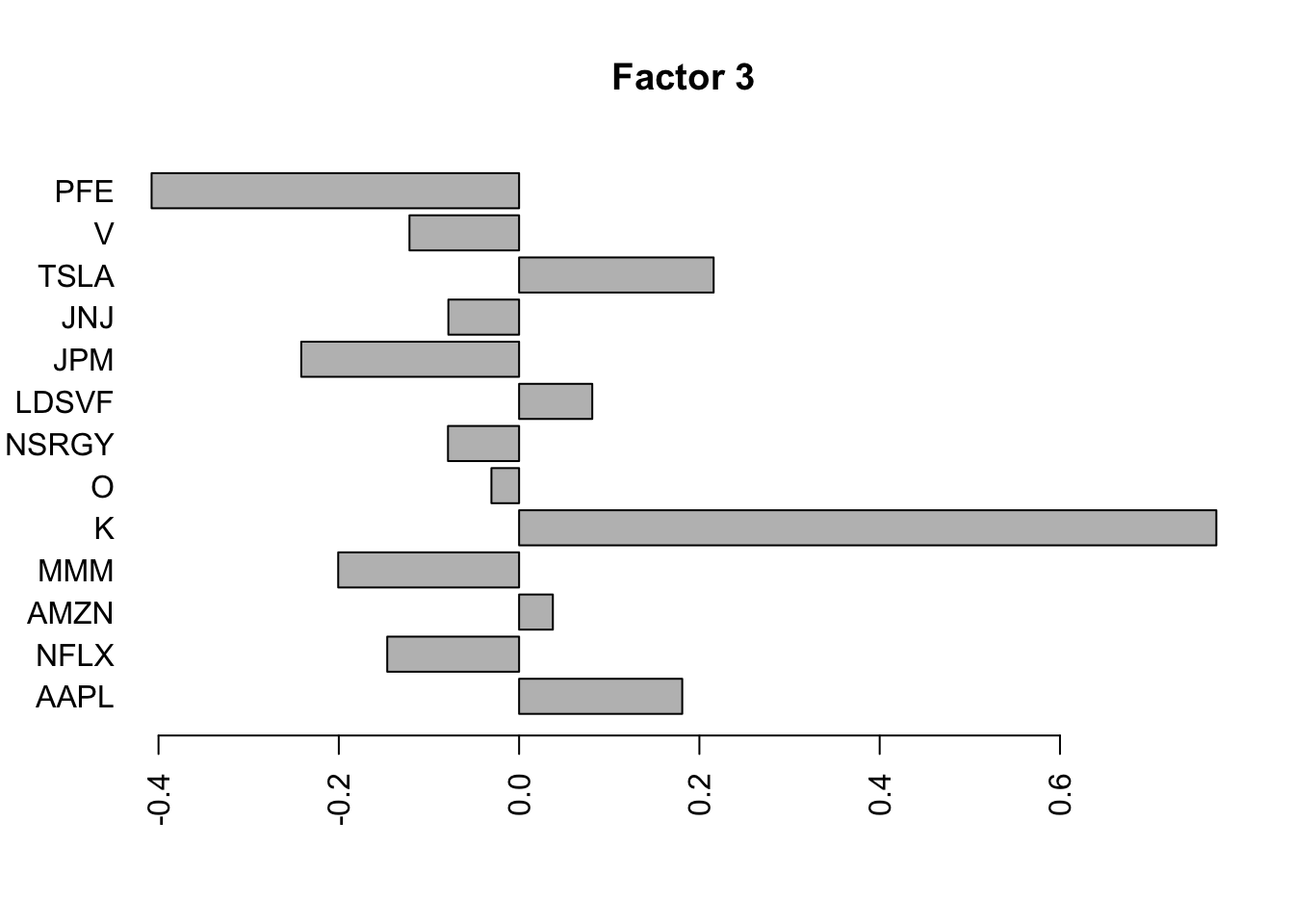

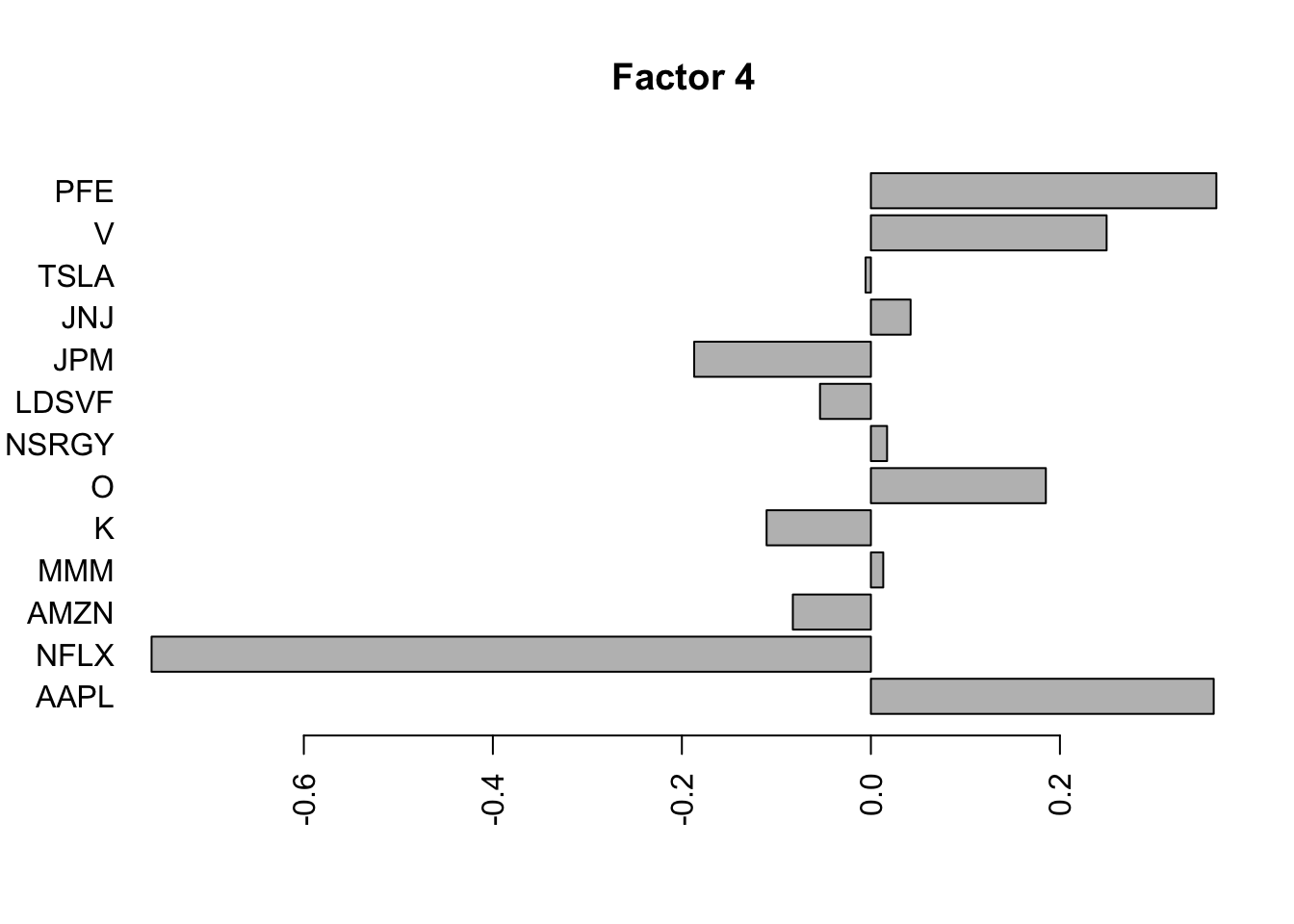

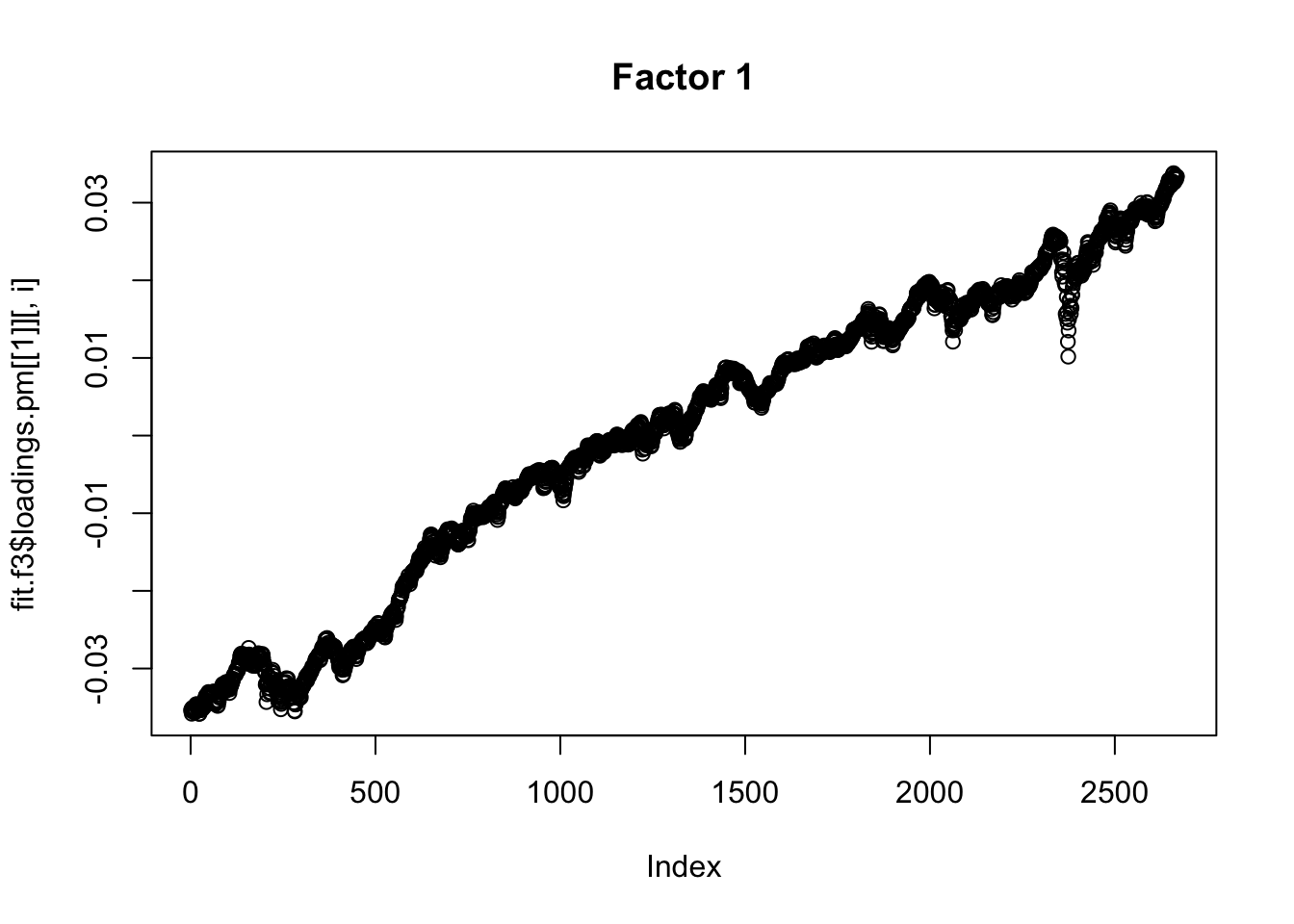

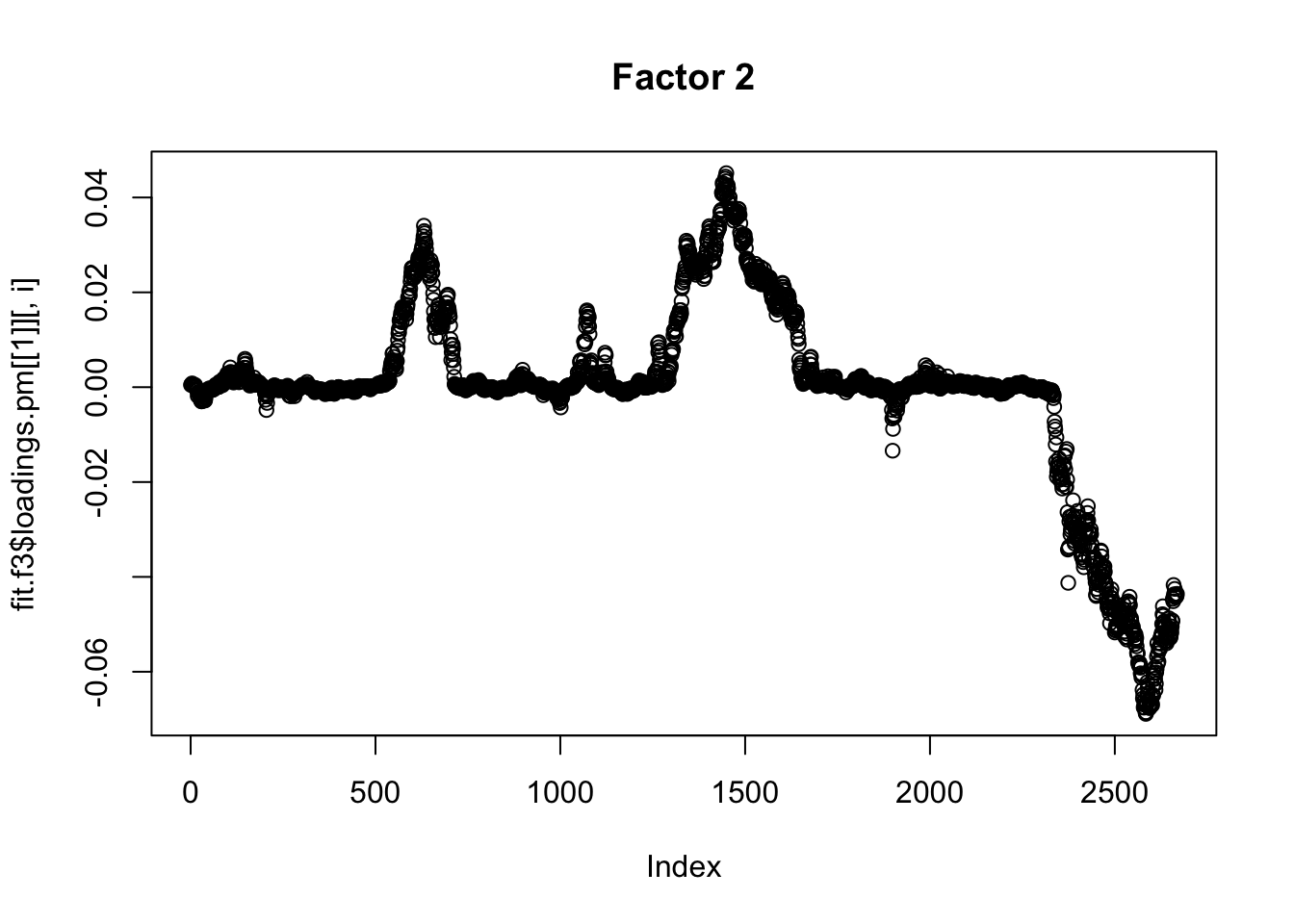

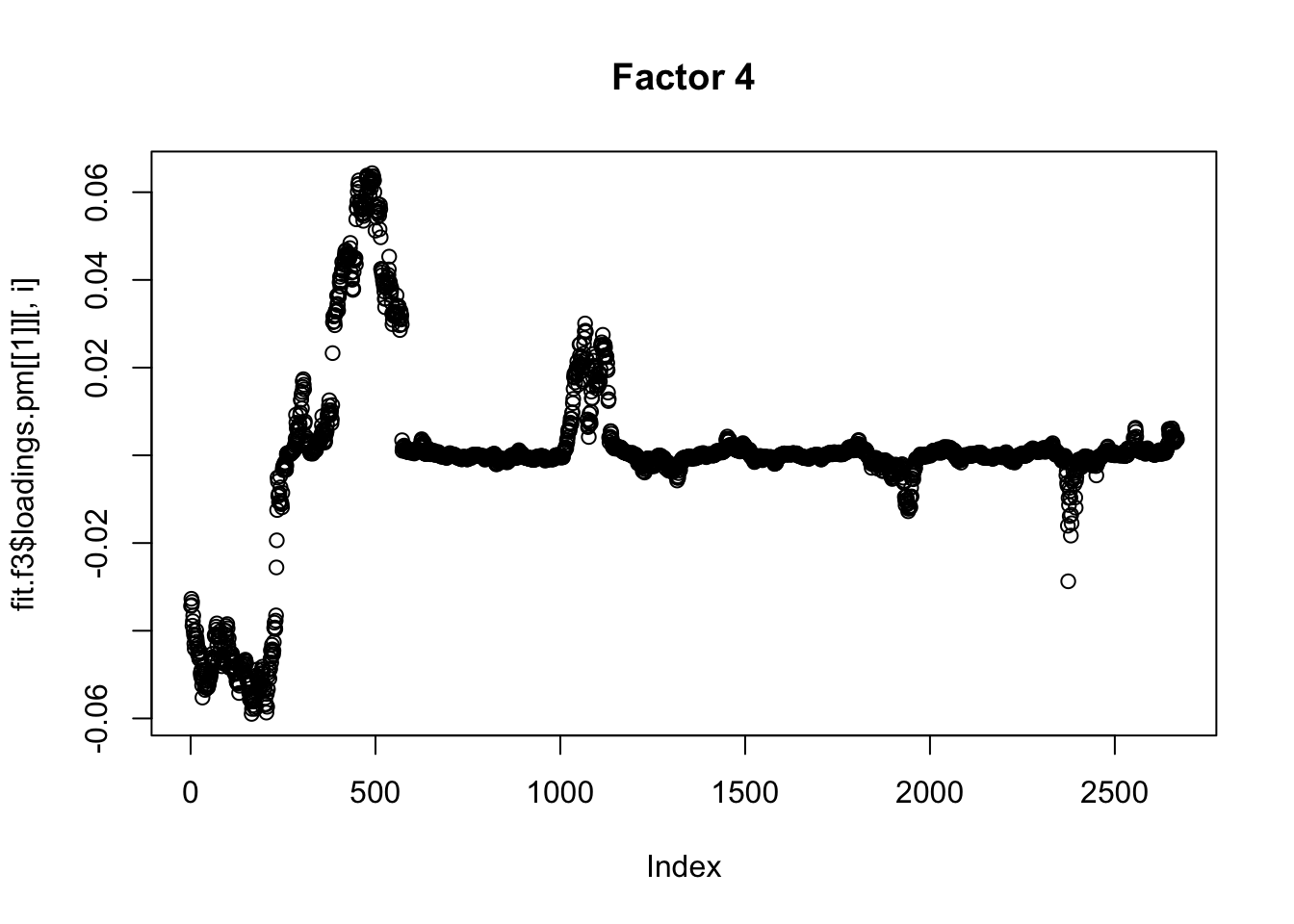

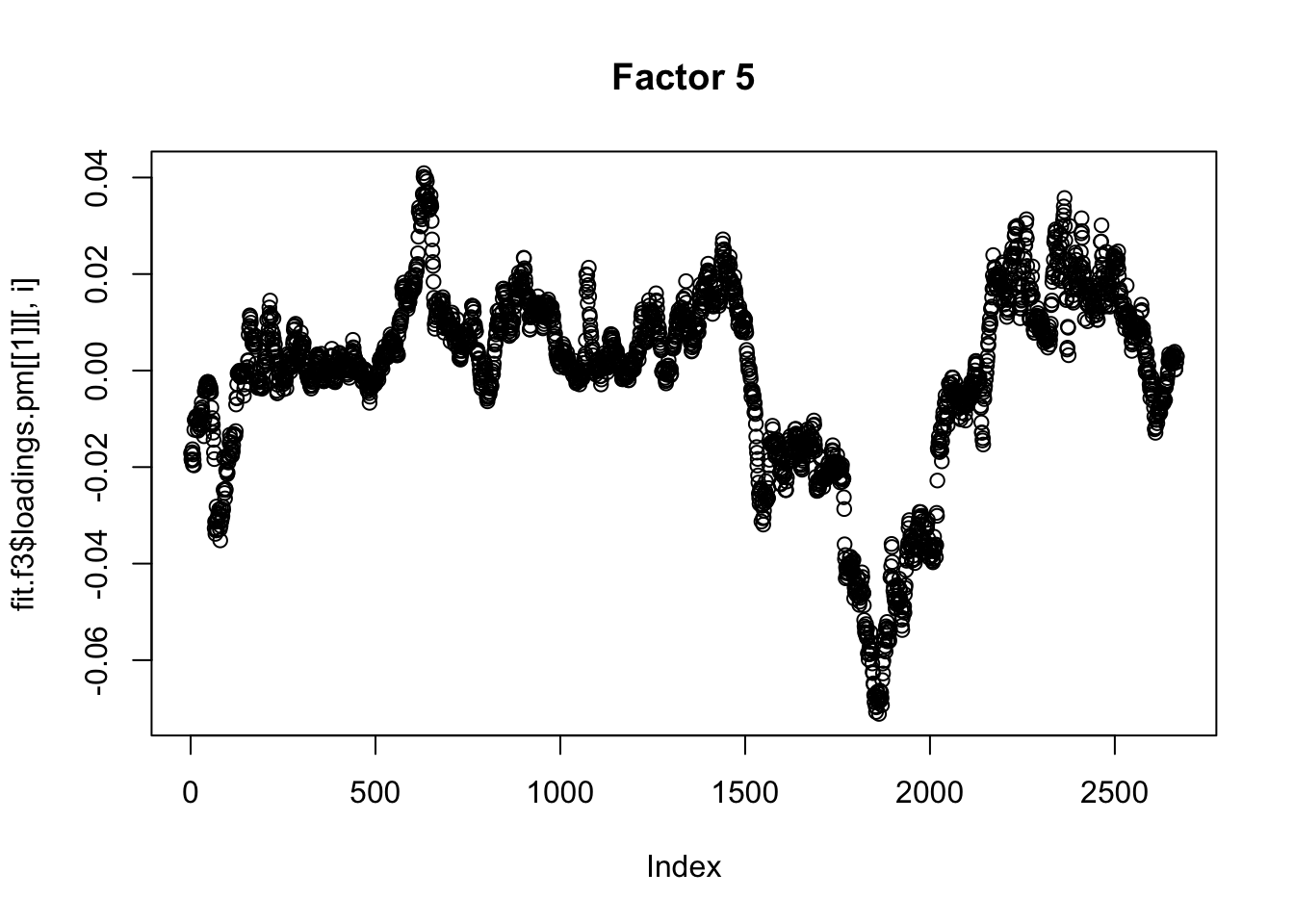

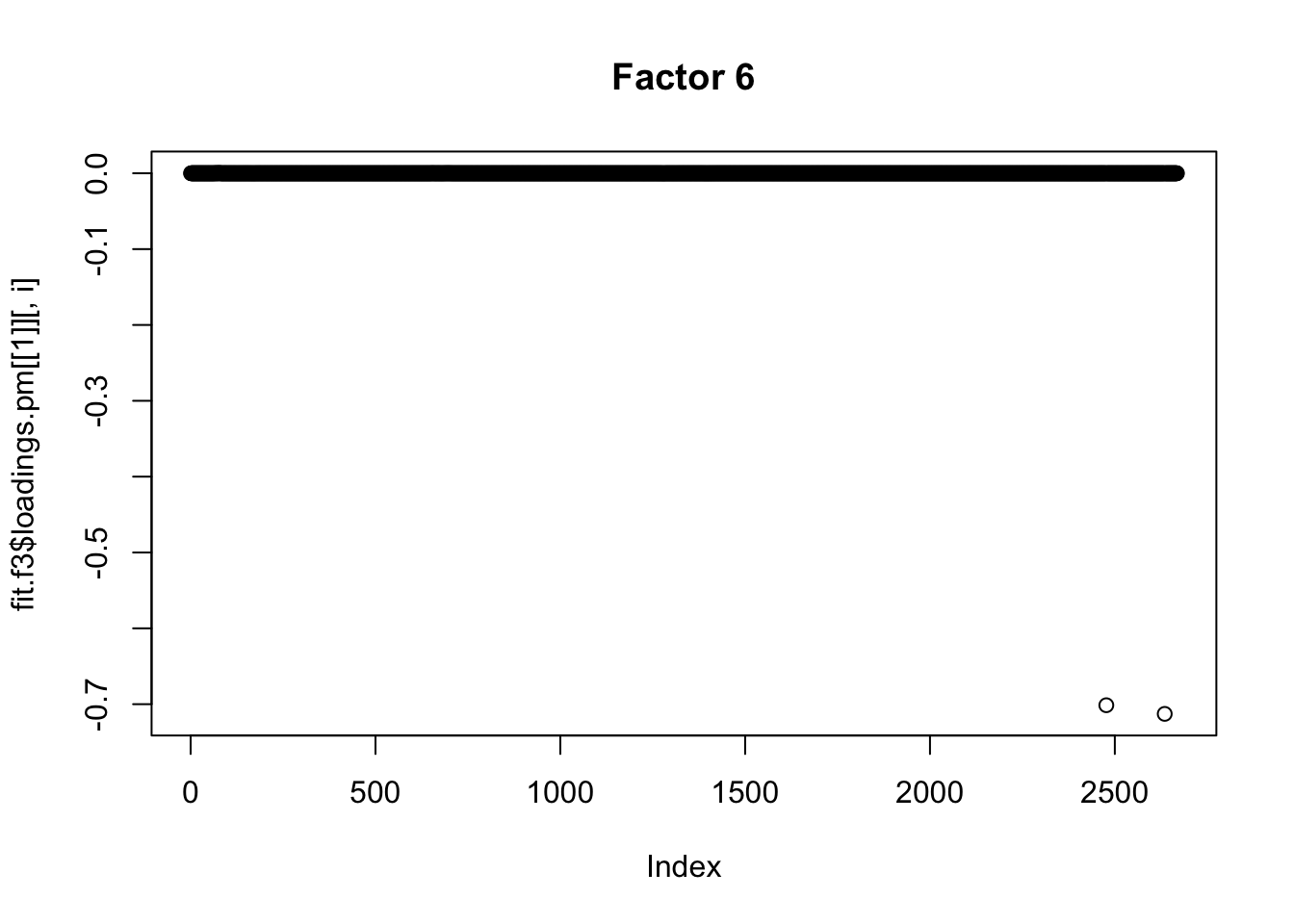

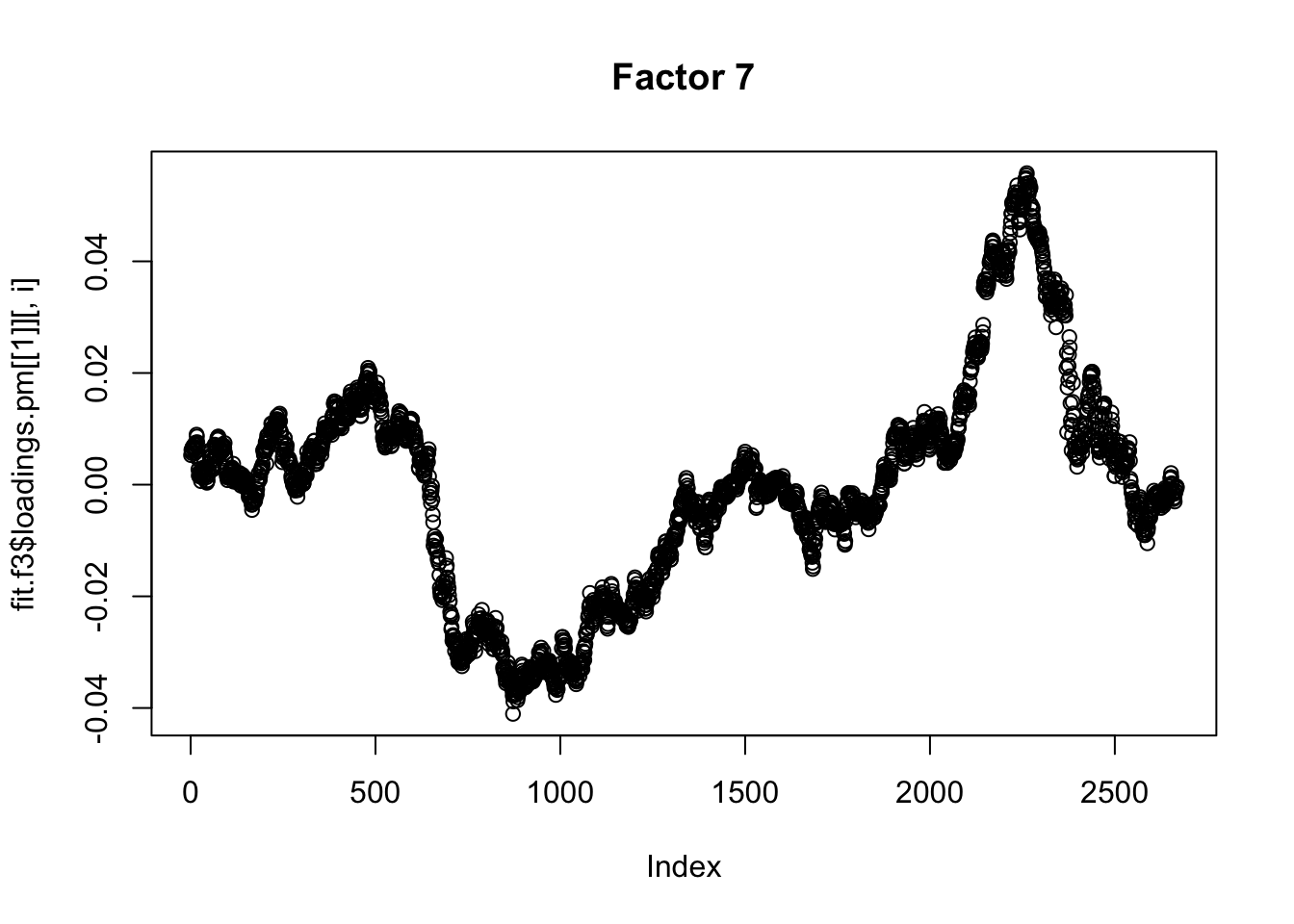

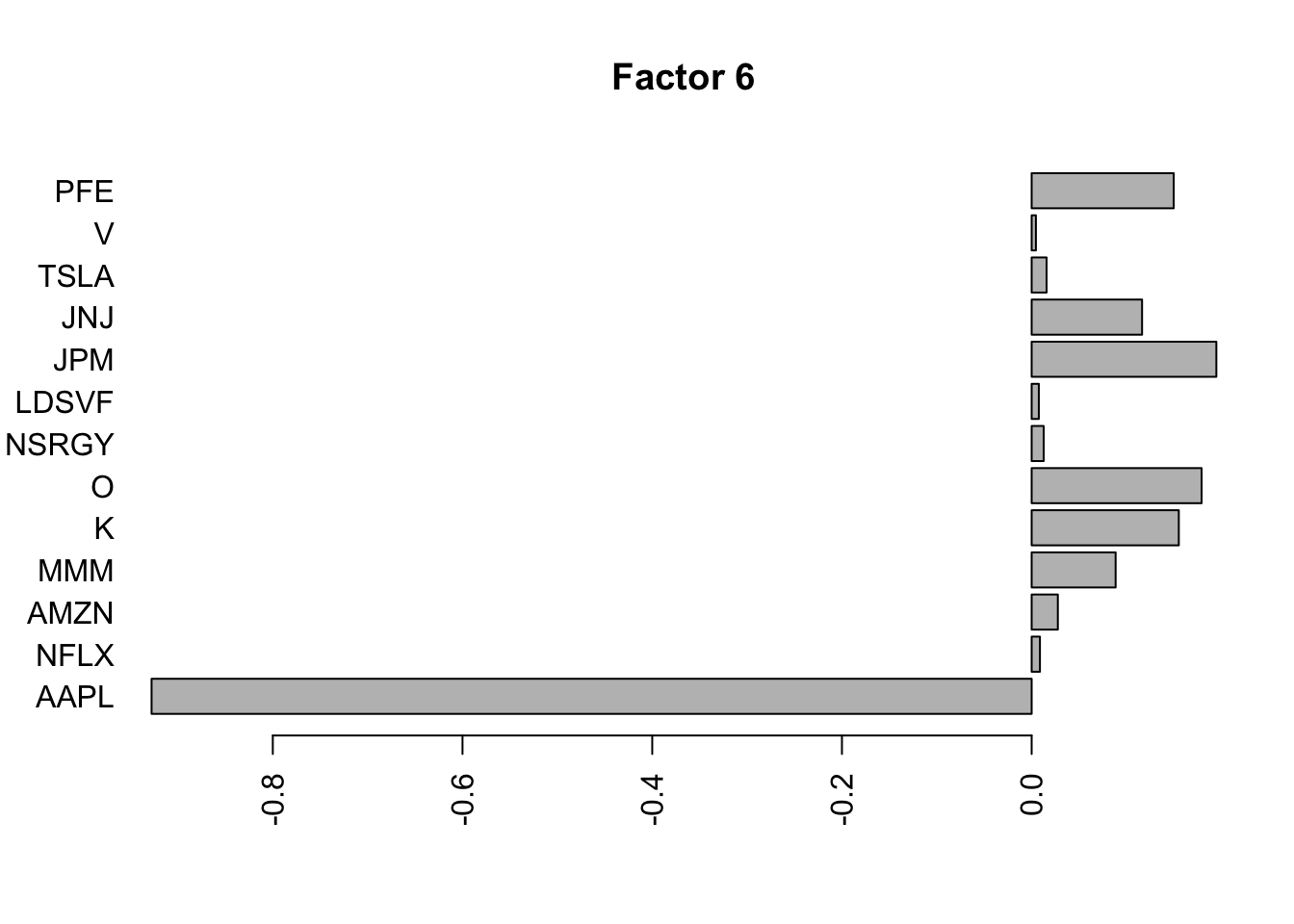

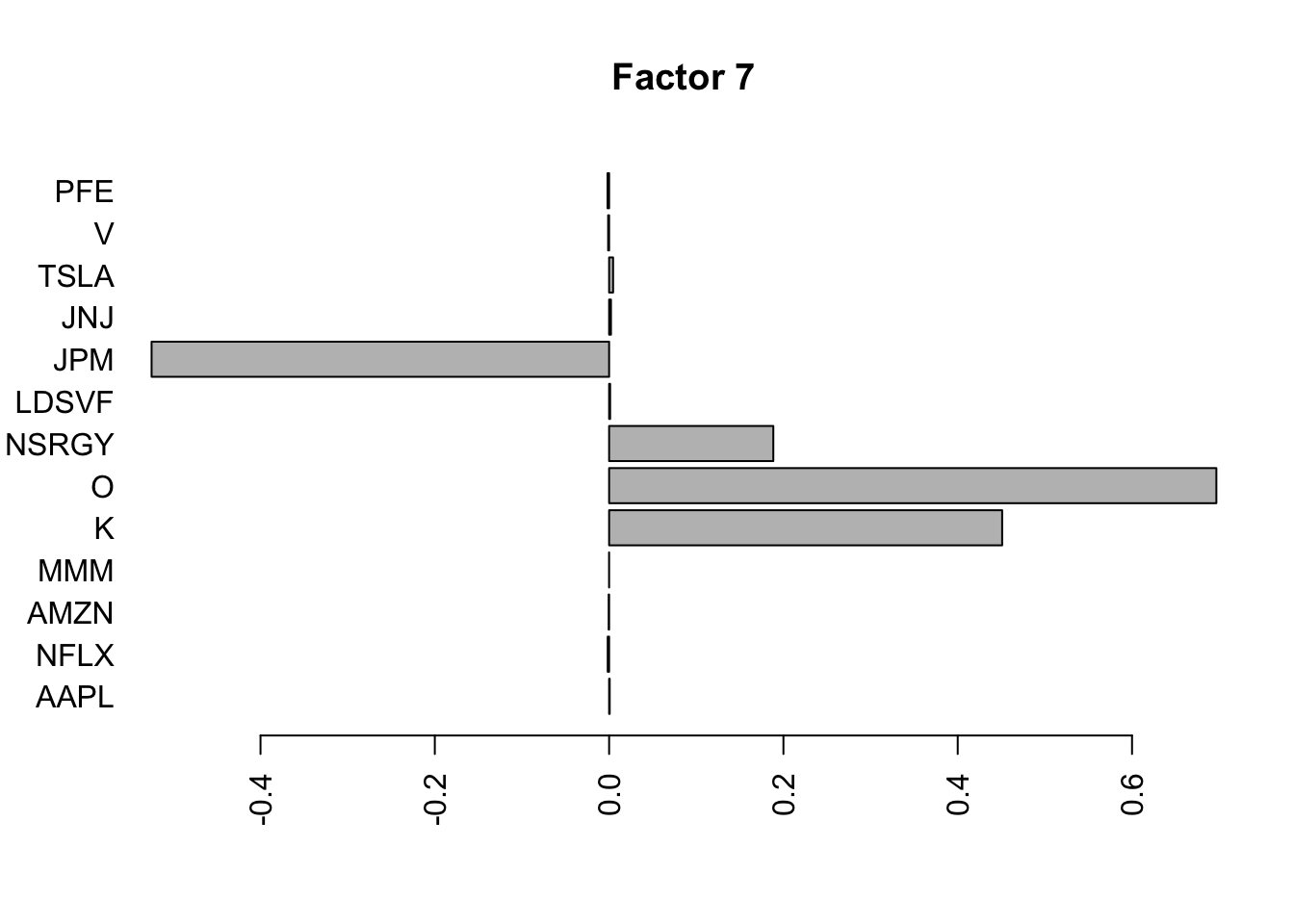

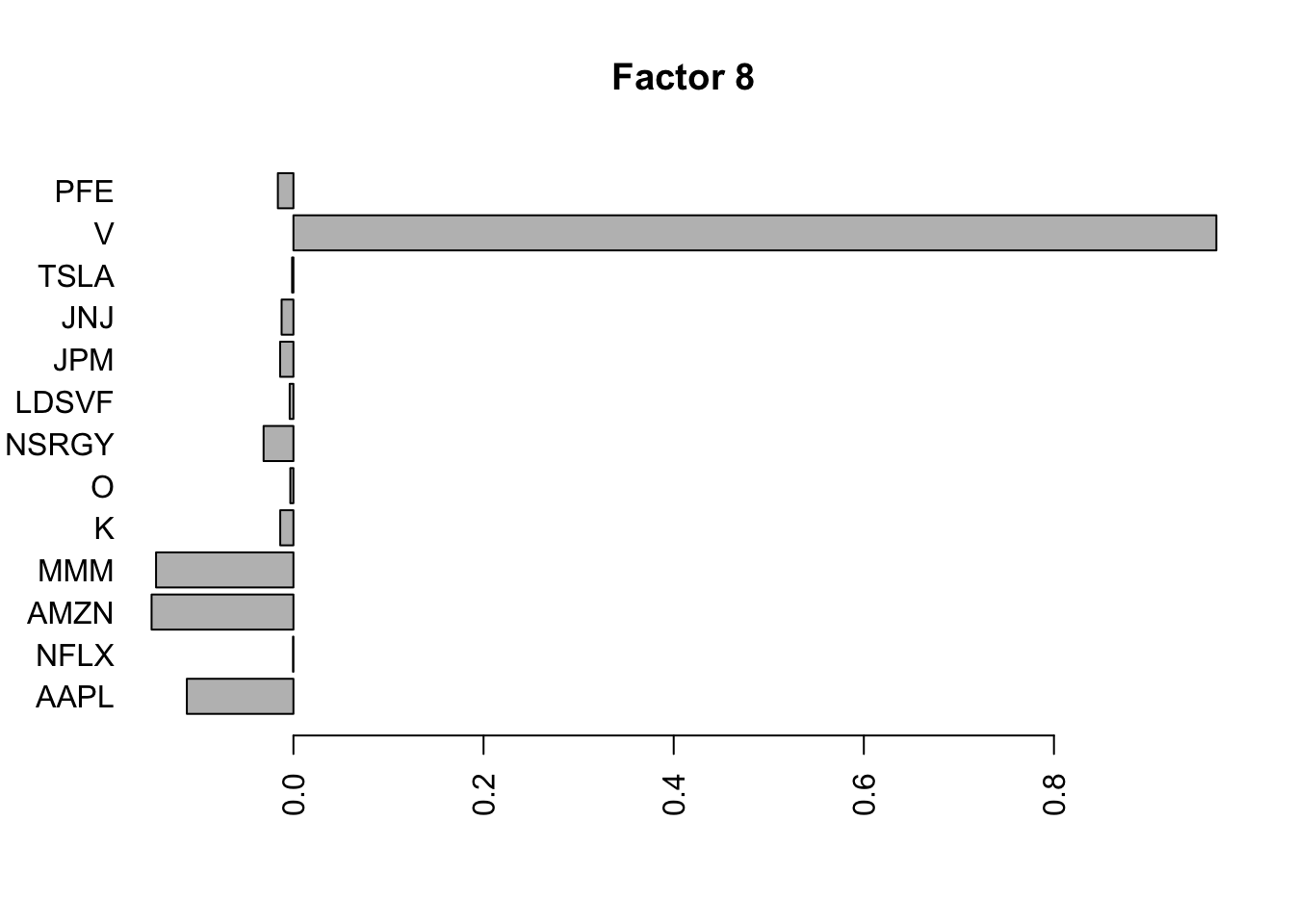

Done.Plot the factors. Note that factor 1 is just a trend and factor 2 looks kind of like a sine wave…. is this just an artifact of looking at time series data? This result does maybe suggest that the data are auto-correlated along the time series.

for(i in 1:8){

barplot(fit.f$loadings.pm[[2]][,i], names.arg=names(prices), horiz=TRUE,las=2, main=paste0("Factor ",i))

}

for(i in 1:8){

plot(fit.f$loadings.pm[[1]][,i], main=paste0("Factor ",i))

}

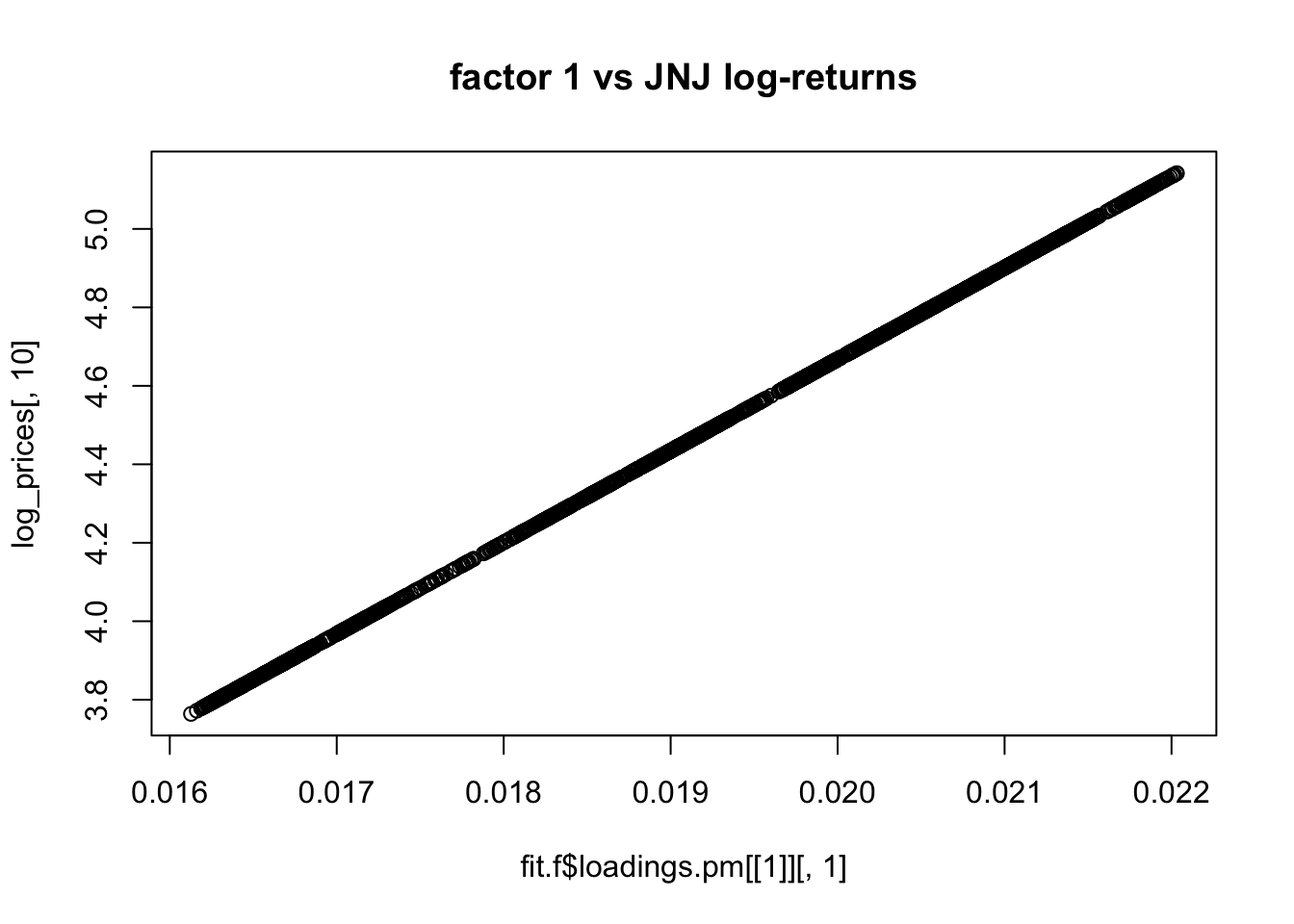

JNJ issue, and residual variance

I was curious when I noticed that JNJ does not seem to belong to any factors except the first! In fact the first factor seems to be exactly JNJs log returns. It is overfitting and giving a very small residual variance for that stock…

fit.f$residuals.sd AAPL NFLX AMZN MMM K O

0.0884707914 0.1118814445 0.1212804169 0.0192397656 0.0567952716 0.0754391674

NSRGY LDSVF JPM JNJ TSLA V

0.0465249352 0.0689714652 0.0878101048 0.0004986196 0.0949300537 0.0393732055

PFE

0.0577105742 plot(fit.f$loadings.pm[[1]][,1],log_prices[,10], main="factor 1 vs JNJ log-returns")

Here I try using no column-specific variance to avoid that overfitting. I think this is a better idea. Now the first 3 factors kind of all look like the fourier components….

fit.f2 = flashier::flash(as.matrix(log_prices),prior.family = prior.point.laplace(), var.type = 0, backfit = TRUE)Adding factor 1 to flash object...

Adding factor 2 to flash object...

Adding factor 3 to flash object...

Adding factor 4 to flash object...

Adding factor 5 to flash object...

Adding factor 6 to flash object...

Factor doesn't significantly increase objective and won't be added.

Wrapping up...

Done.

Backfitting 5 factors (tolerance: 5.17e-04)...

Difference between iterations is within 1.0e+03...

Difference between iterations is within 1.0e+02...

Difference between iterations is within 1.0e+01...

Difference between iterations is within 1.0e+00...

Difference between iterations is within 1.0e-01...

Difference between iterations is within 1.0e-02...

Difference between iterations is within 1.0e-03...

Wrapping up...

Done.

Nullchecking 5 factors...

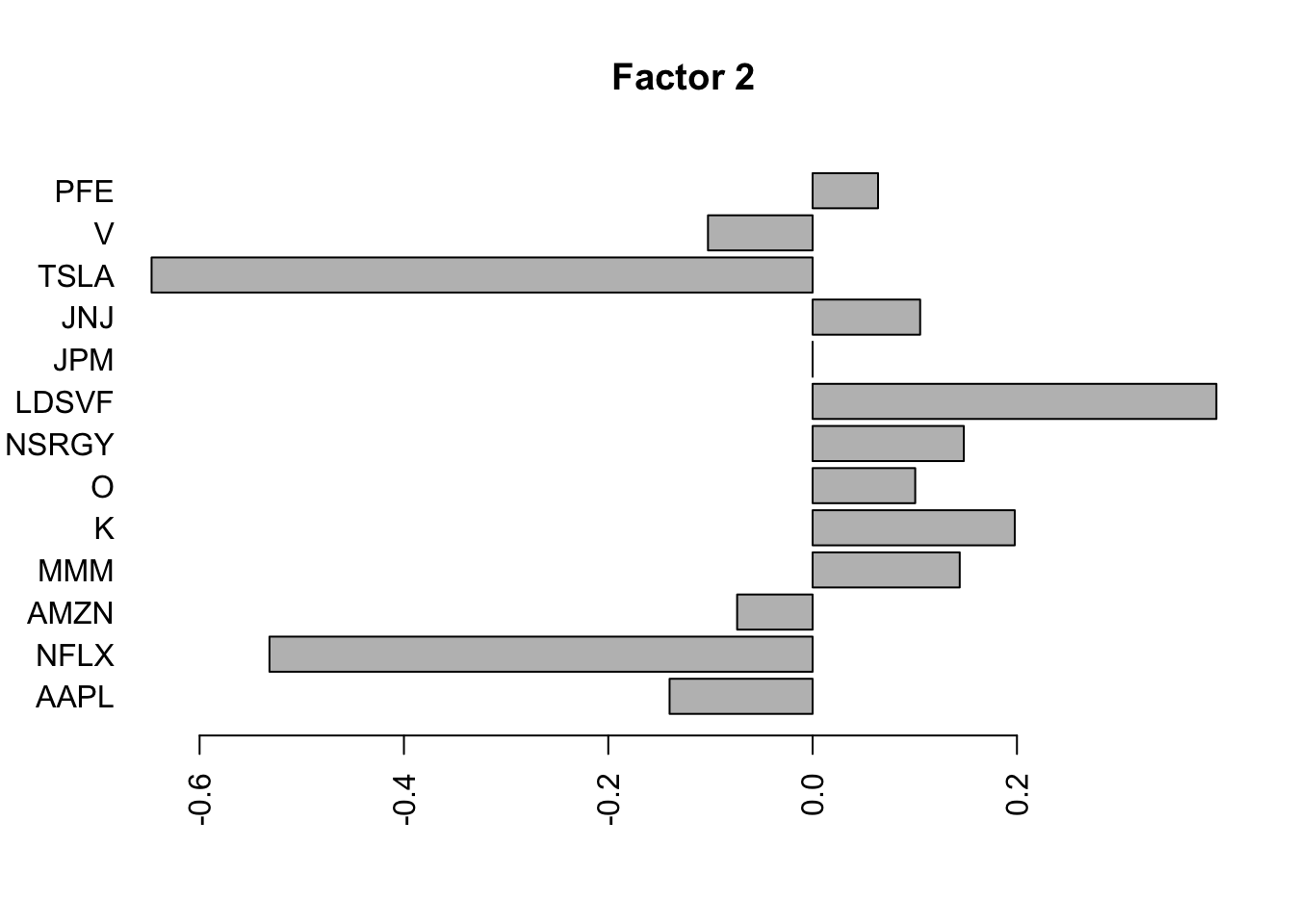

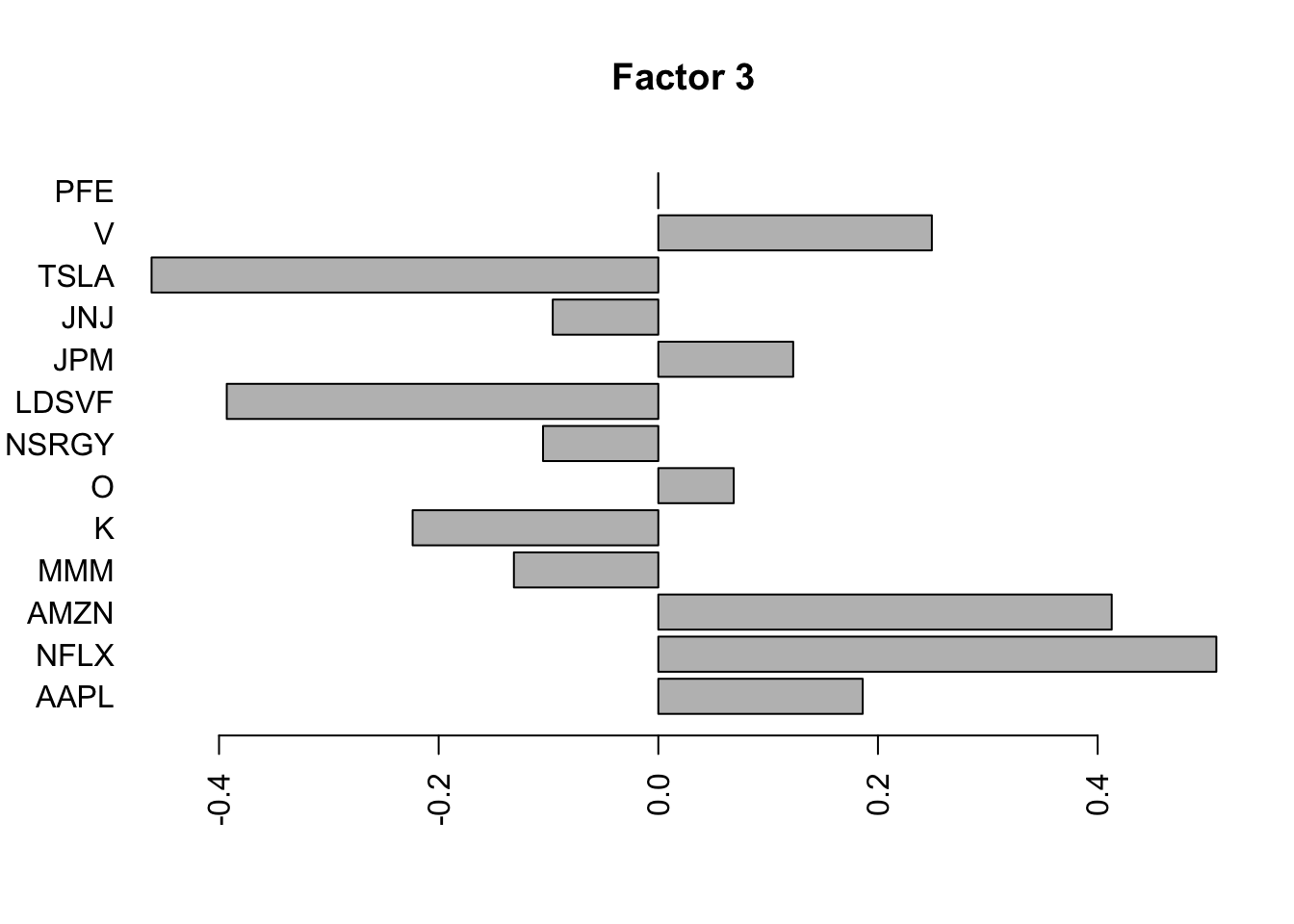

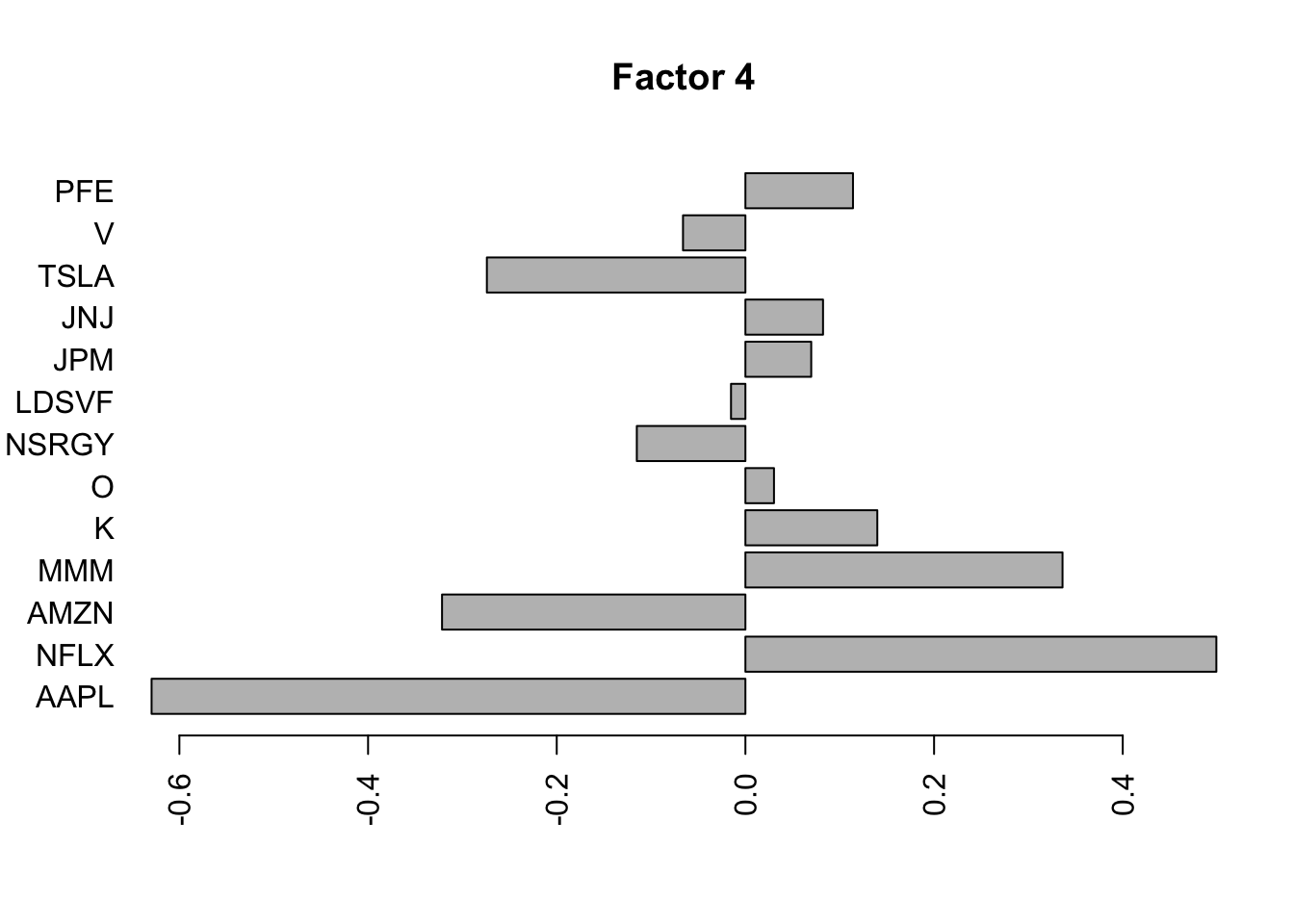

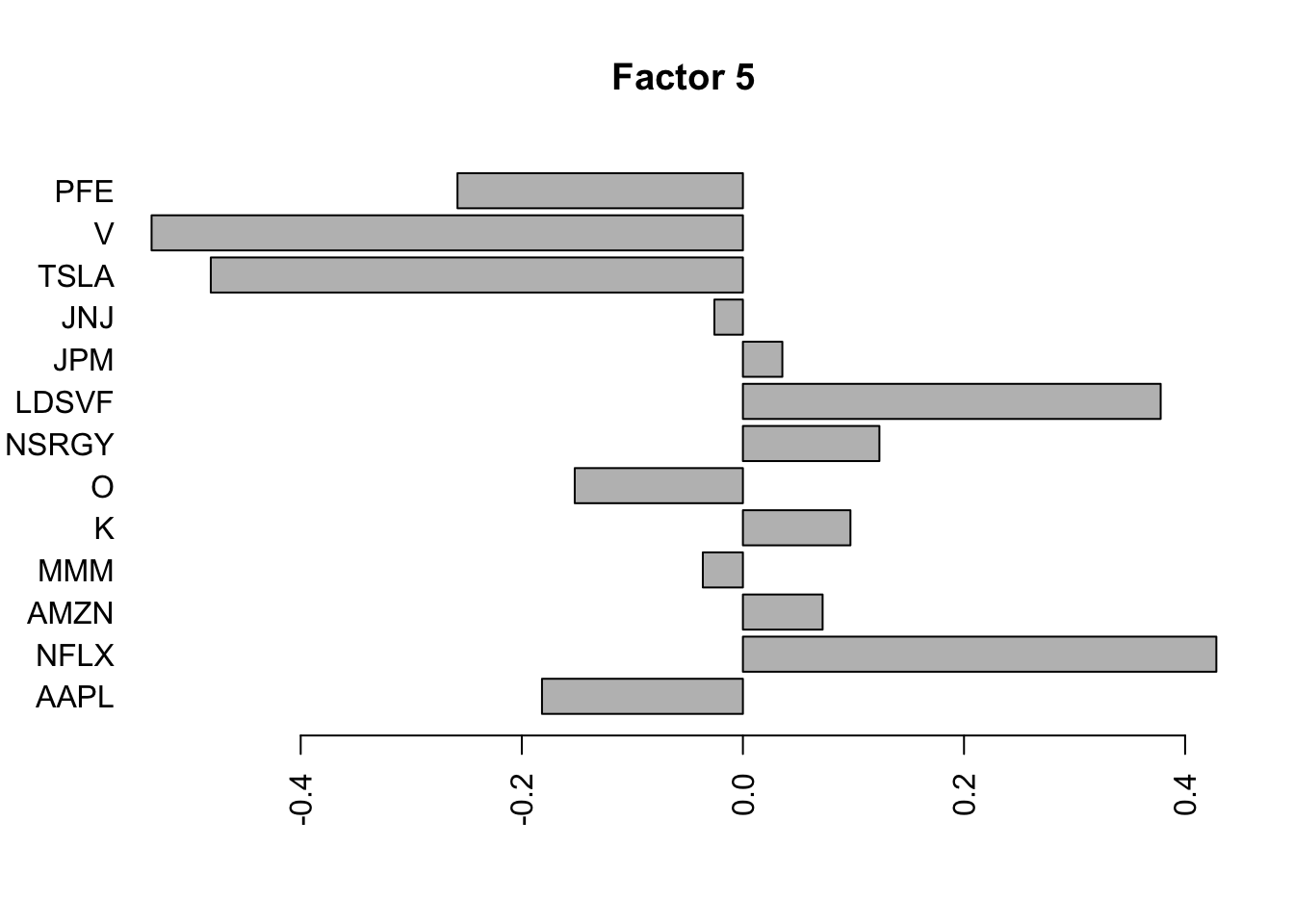

Done.fit.f2$residuals.sd[1] 0.08518904for(i in 1:5){

barplot(fit.f2$loadings.pm[[2]][,i], names.arg=names(prices), horiz=TRUE,las=2, main=paste0("Factor ",i))

}

for(i in 1:5){

plot(fit.f2$loadings.pm[[1]][,i], main=paste0("Factor ",i))

}

Flashier on the correlation matrix

Try factor analysis on the correlation matrix. I found it interesting that in the raw data analysis LDSVF was loaded on the first factor, but not in the correlation analysis, which I guess is because the correlation removes some of the overall mean effect and LDSVF is almost independent of others after that is removed?

Also, I feel like the raw correlation matrix shows some additional structure that is likely to be real – eg PFE and JNJ correlation – that is not picked out here….but maybe that is naive on my part.

Smiss = S

diag(Smiss) <- NA

S.f = flashier::flash(Smiss,prior.family = prior.point.laplace(), var.type = 0)Adding factor 1 to flash object...

Adding factor 2 to flash object...

Adding factor 3 to flash object...

Factor doesn't significantly increase objective and won't be added.

Wrapping up...

Done.

Nullchecking 2 factors...

Done.for(i in 1:2){

barplot(S.f$loadings.pm[[2]][,i], names.arg=names(prices), horiz=TRUE,las=2, main=paste0("Factor ",i))

}

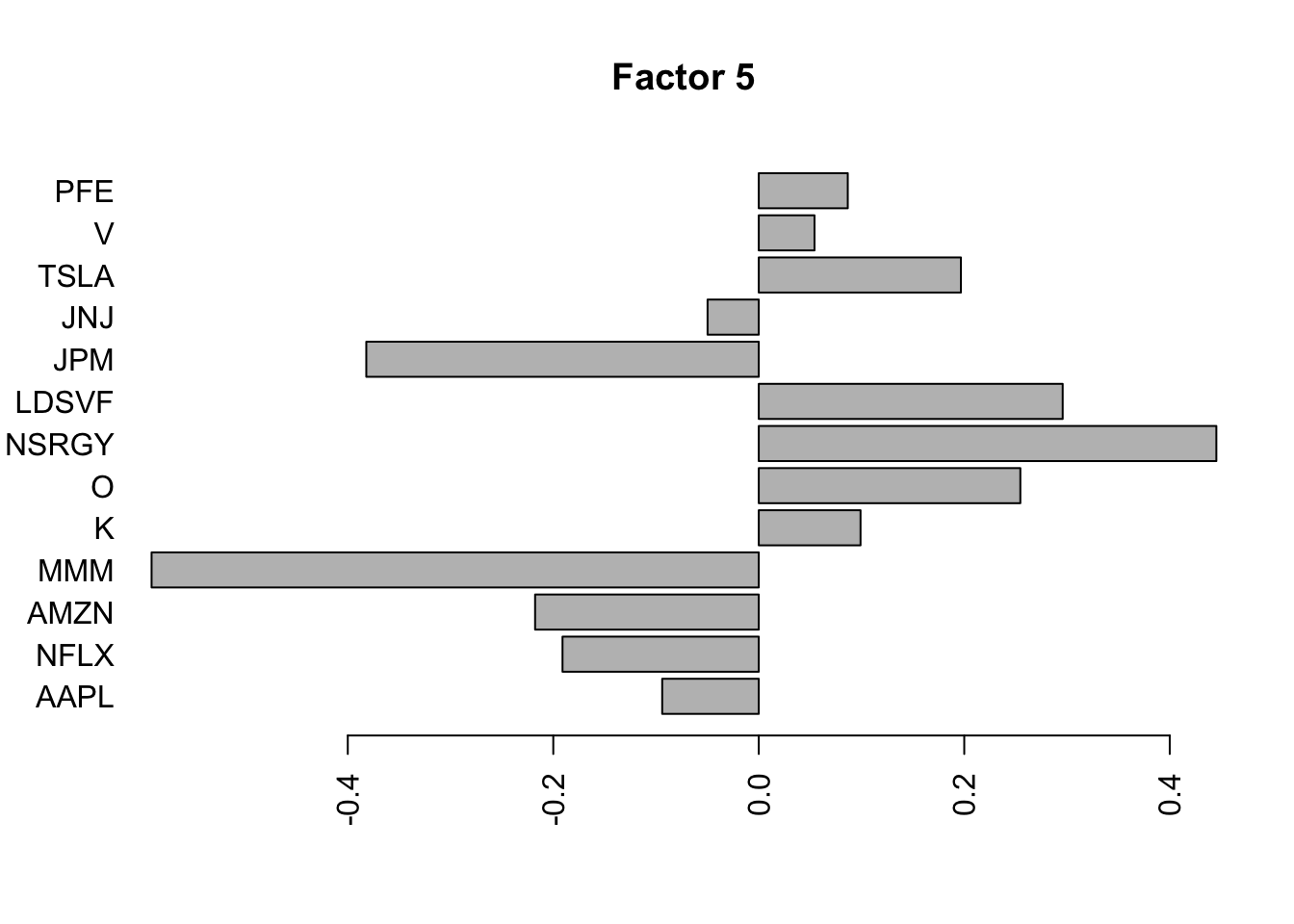

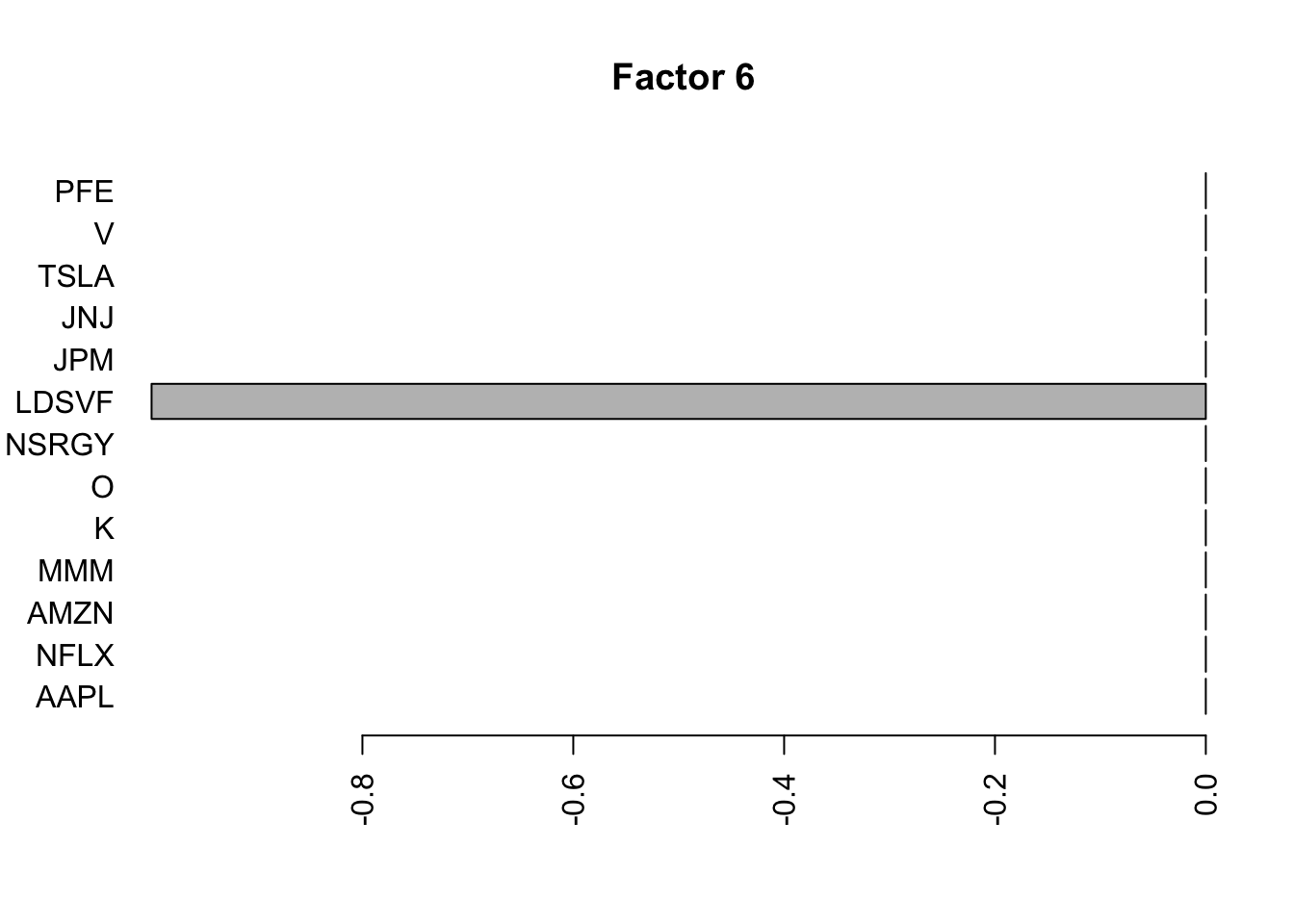

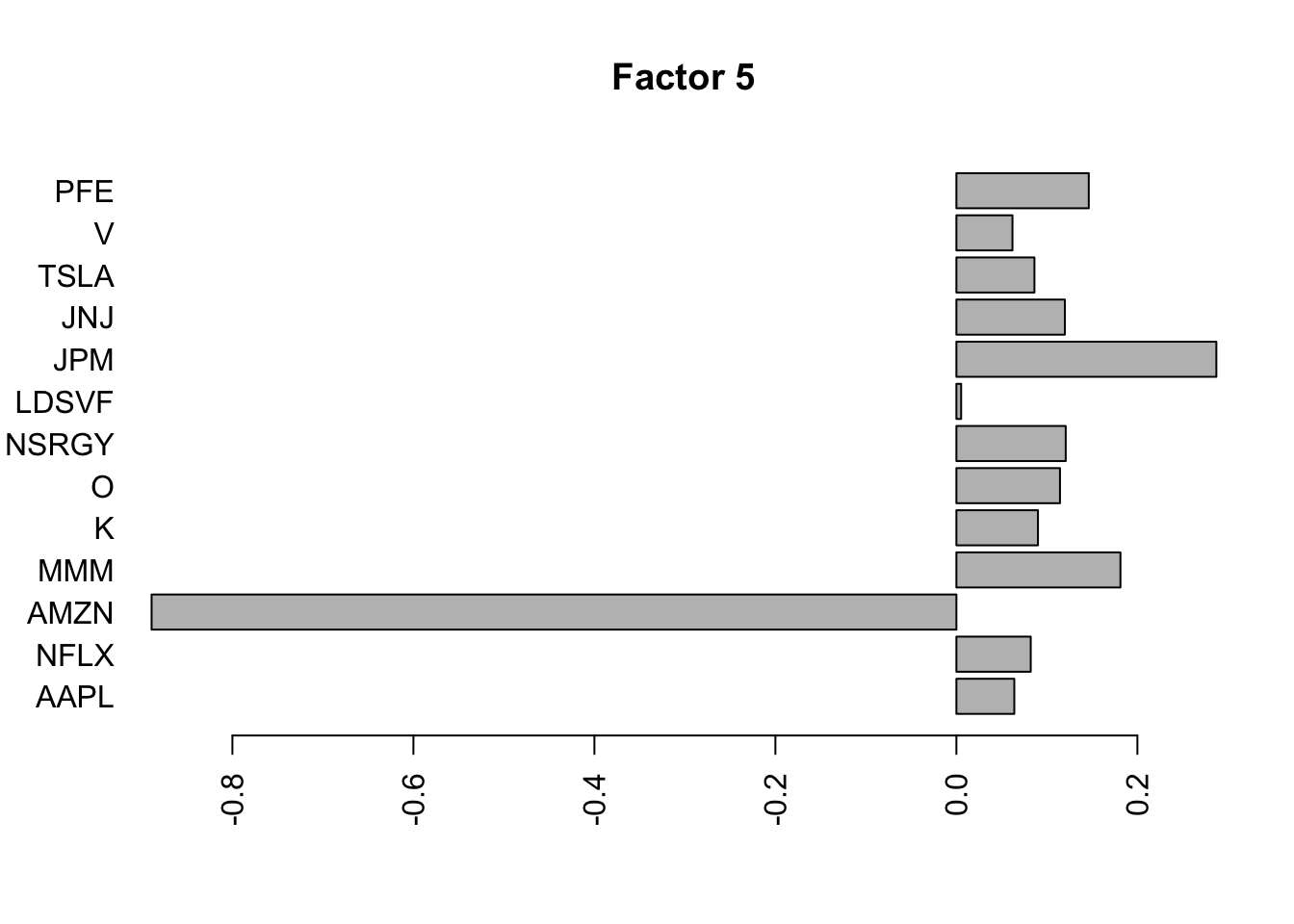

Flashier on the standardized raw data

I was kind of surprised no factor picked out the JNJ/PFE correlation, so I tried rerunning on the standardized raw data. It still did not pick that out as a separate factor, but maybe it is naive to think things would be as simple as that.

fit.f3 = flashier::flash(scale(log_prices),prior.family = prior.point.laplace(), var.type = 0, backfit = TRUE)Adding factor 1 to flash object...

Adding factor 2 to flash object...

Adding factor 3 to flash object...

Adding factor 4 to flash object...

Adding factor 5 to flash object...

Adding factor 6 to flash object...

Adding factor 7 to flash object...

Adding factor 8 to flash object...

Factor doesn't significantly increase objective and won't be added.

Wrapping up...

Done.

Backfitting 7 factors (tolerance: 5.17e-04)...

Difference between iterations is within 1.0e+03...

Difference between iterations is within 1.0e+02...

Difference between iterations is within 1.0e+01...

Difference between iterations is within 1.0e+00...

Difference between iterations is within 1.0e-01...

Difference between iterations is within 1.0e-02...

Difference between iterations is within 1.0e-03...

Wrapping up...

Done.

Nullchecking 7 factors...

Done.for(i in 1:7){

barplot(fit.f3$loadings.pm[[2]][,i], names.arg=names(prices), horiz=TRUE,las=2, main=paste0("Factor ",i))

}

for(i in 1:7){

plot(fit.f3$loadings.pm[[1]][,i], main=paste0("Factor ",i))

}

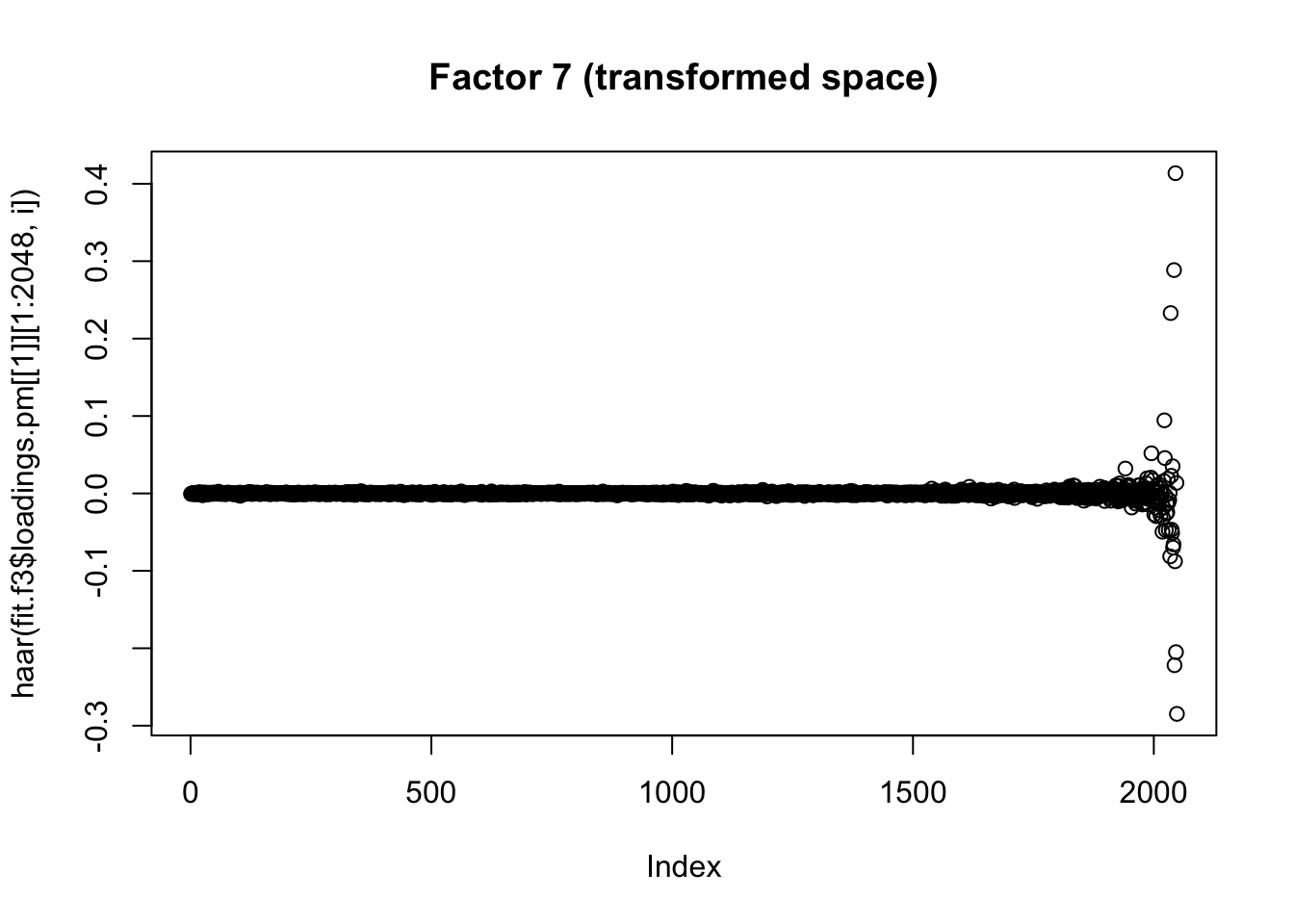

Wavelet transformed data

Since these are time series it would be nice to try wavelet transforming them before applying flashier. Here I explore some of these ideas.

First define haar transform functions

haar = function(x,scale= sqrt(2)){

if(length(x)==1){

return(x)

}

else{

x = matrix(x,nrow=2)

diff = (x[1,]-x[2,])/scale

sum = (x[1,]+x[2,])/scale

return(c(diff, haar(sum)))

}

}

haar_inv = function(x,scale=sqrt(2)){

n=length(x)

if(n==1){

return(x)

}

x = matrix(scale*x,nrow=2,byrow=TRUE)

smoothed = haar_inv(x[2,])

return(as.vector(rbind(smoothed+x[1,], smoothed-x[1,]))/2)

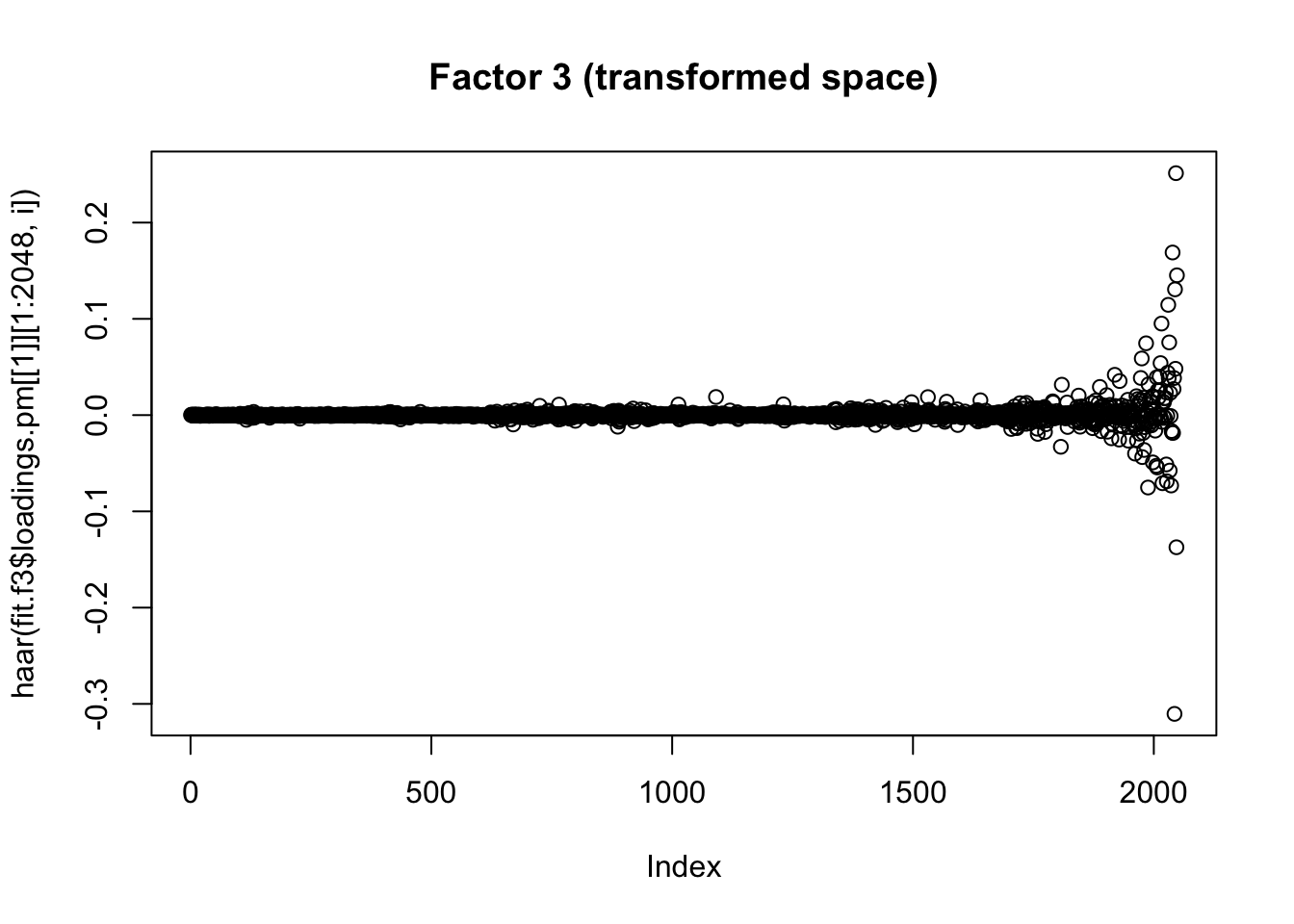

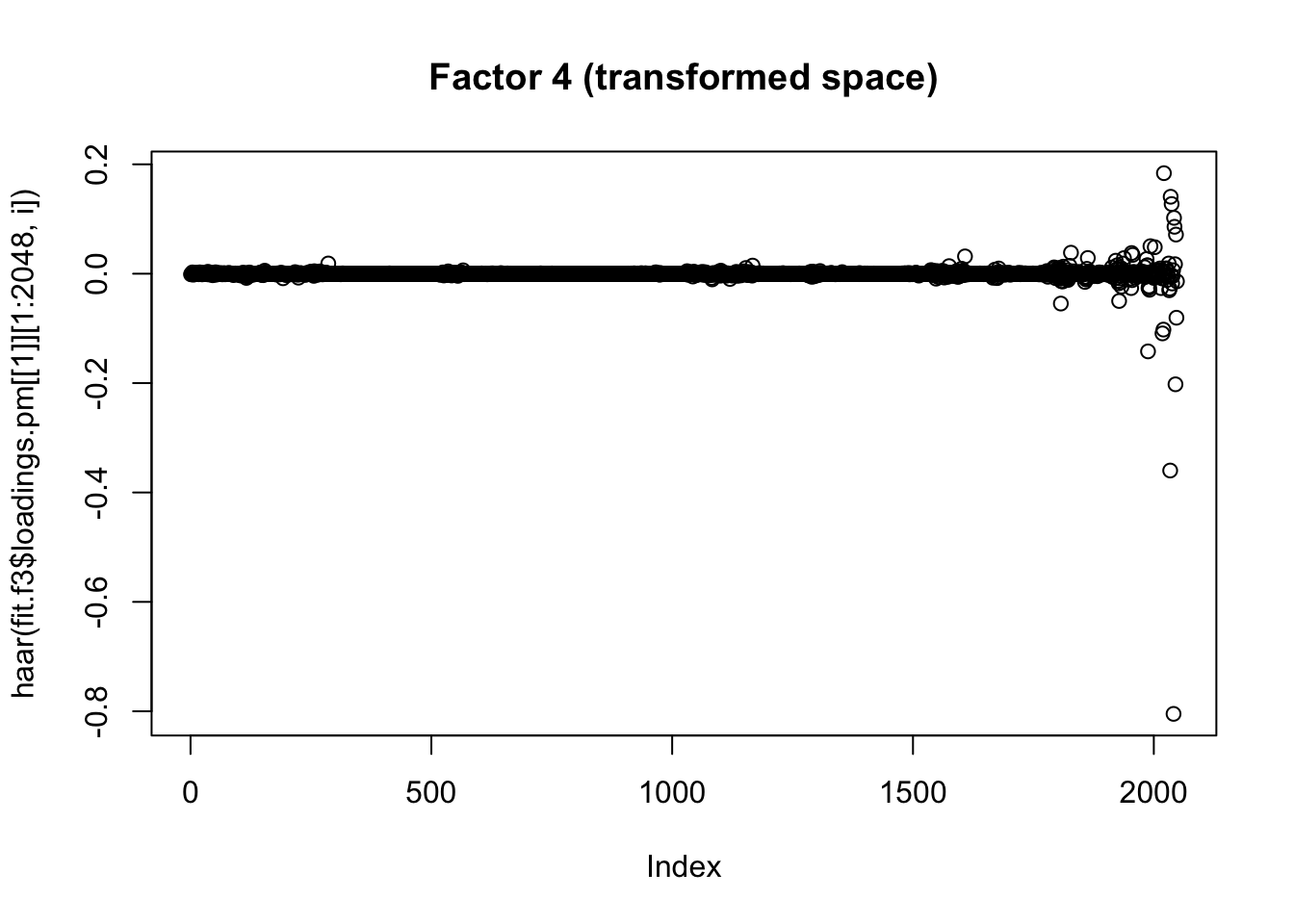

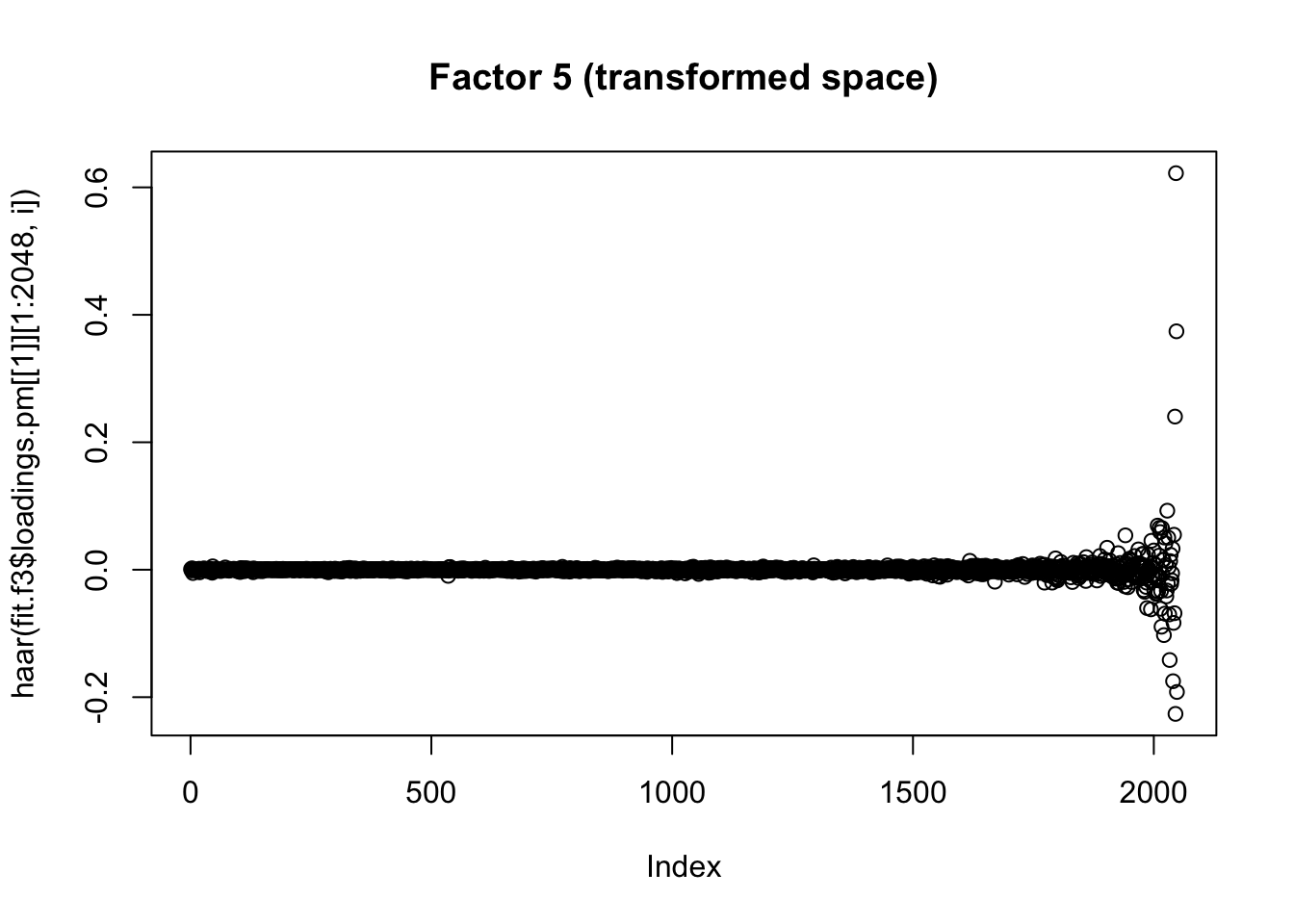

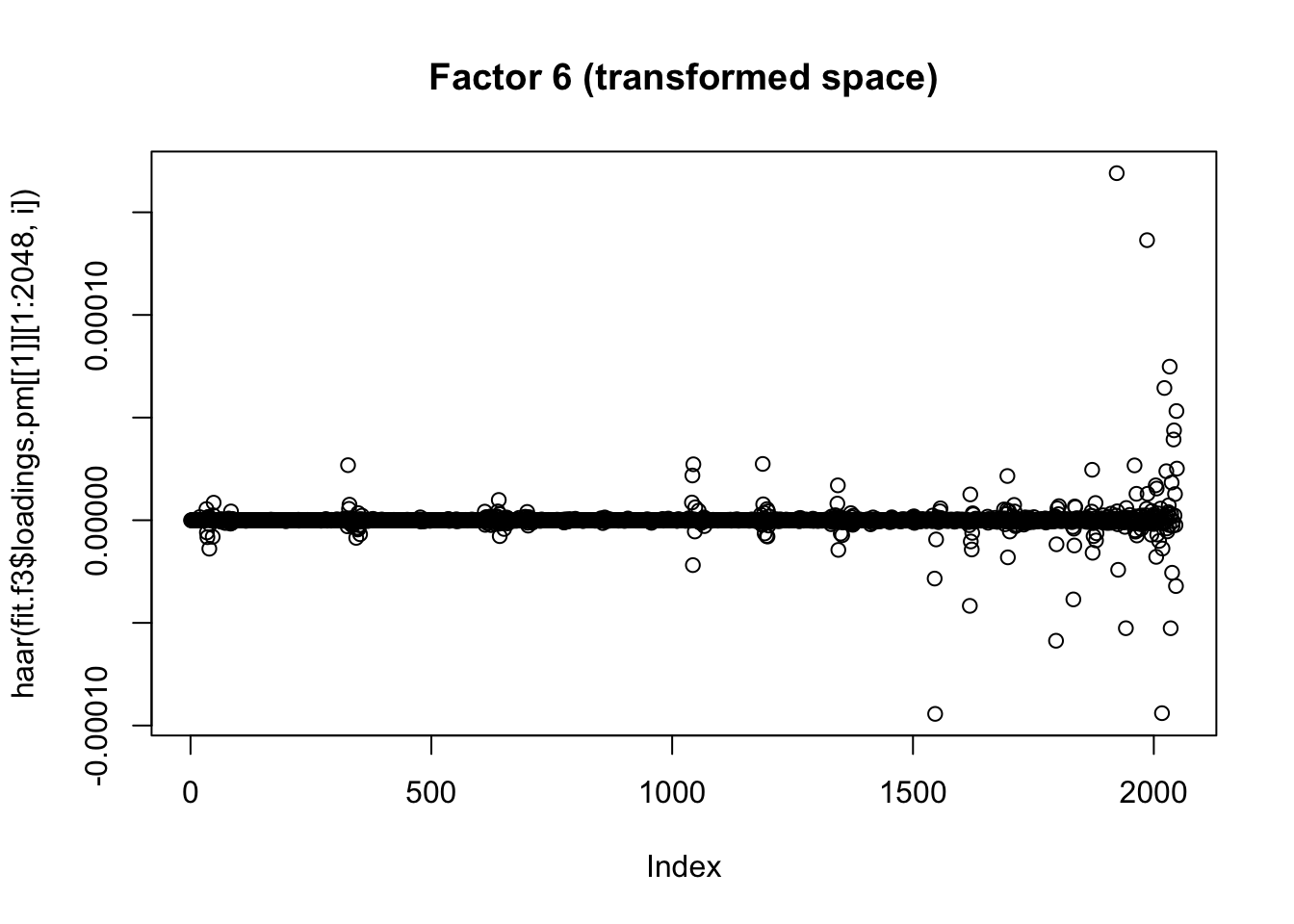

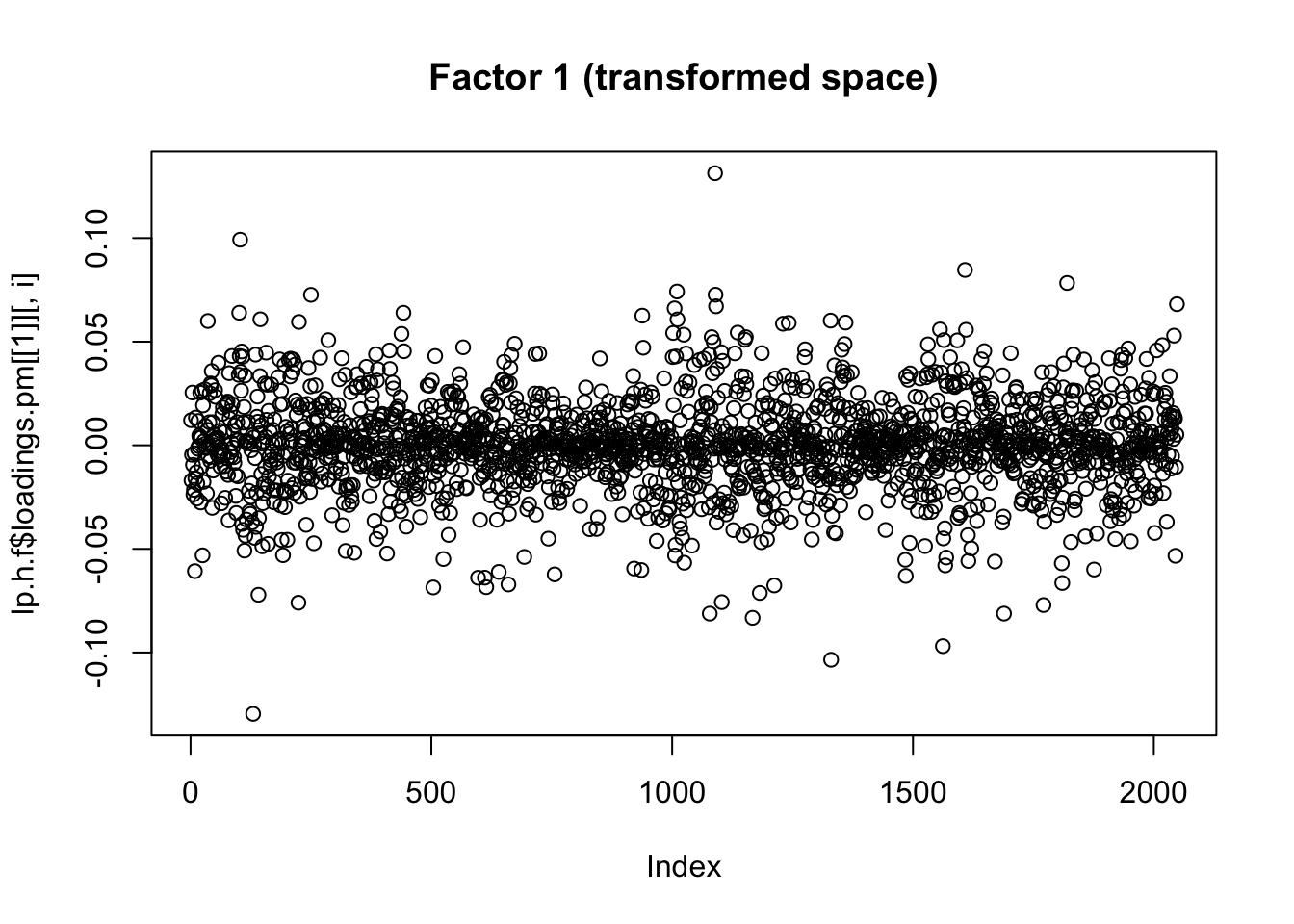

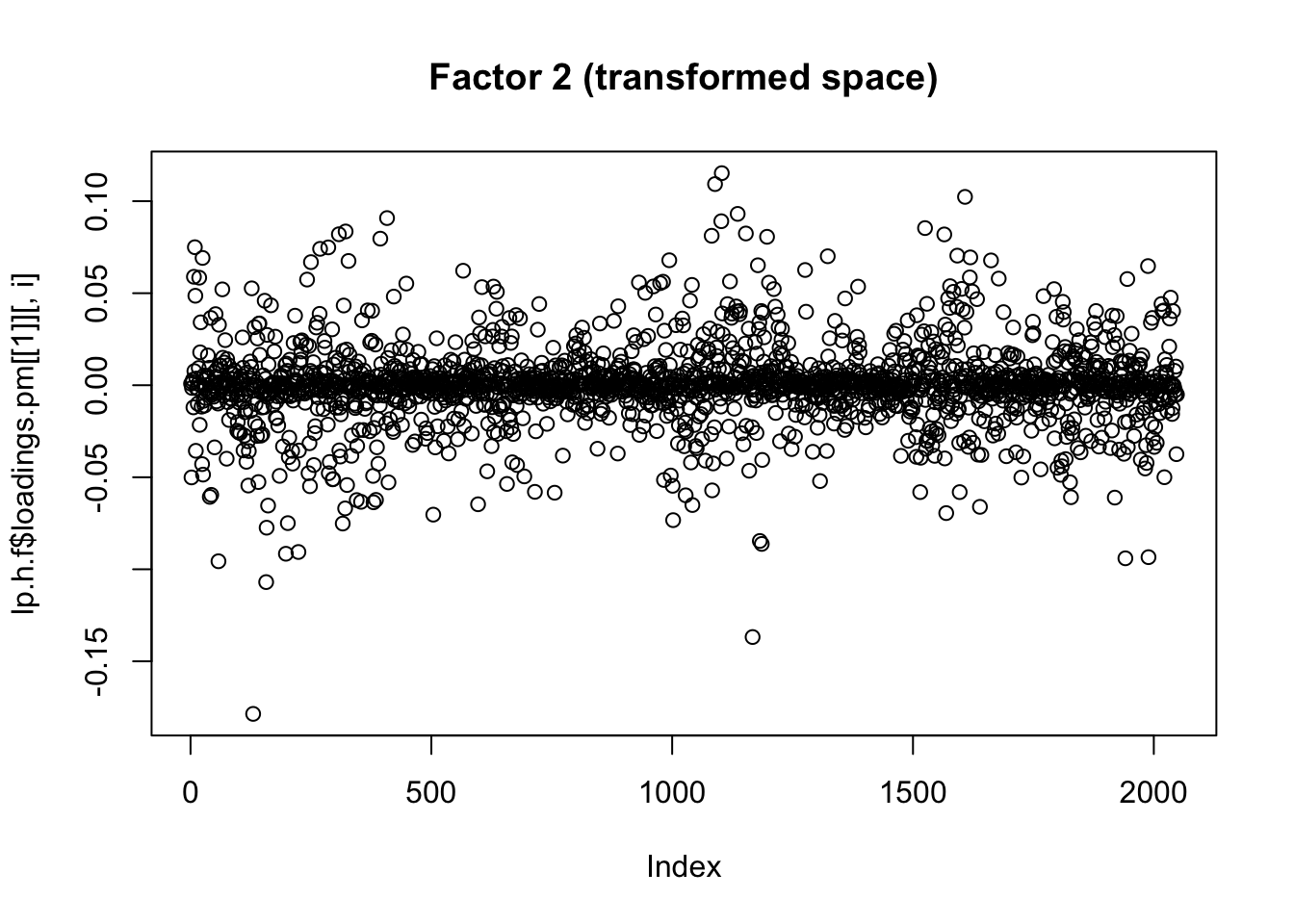

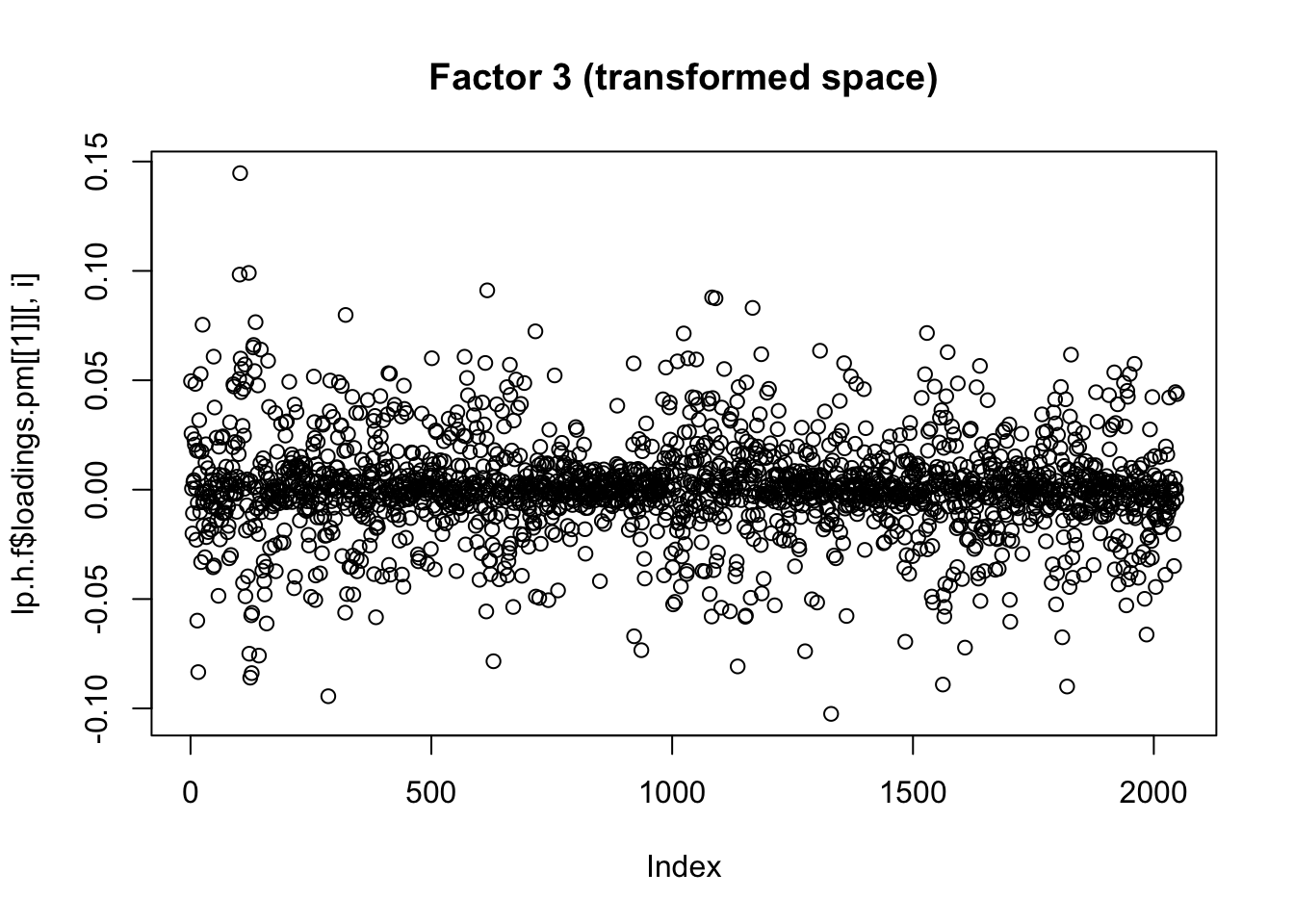

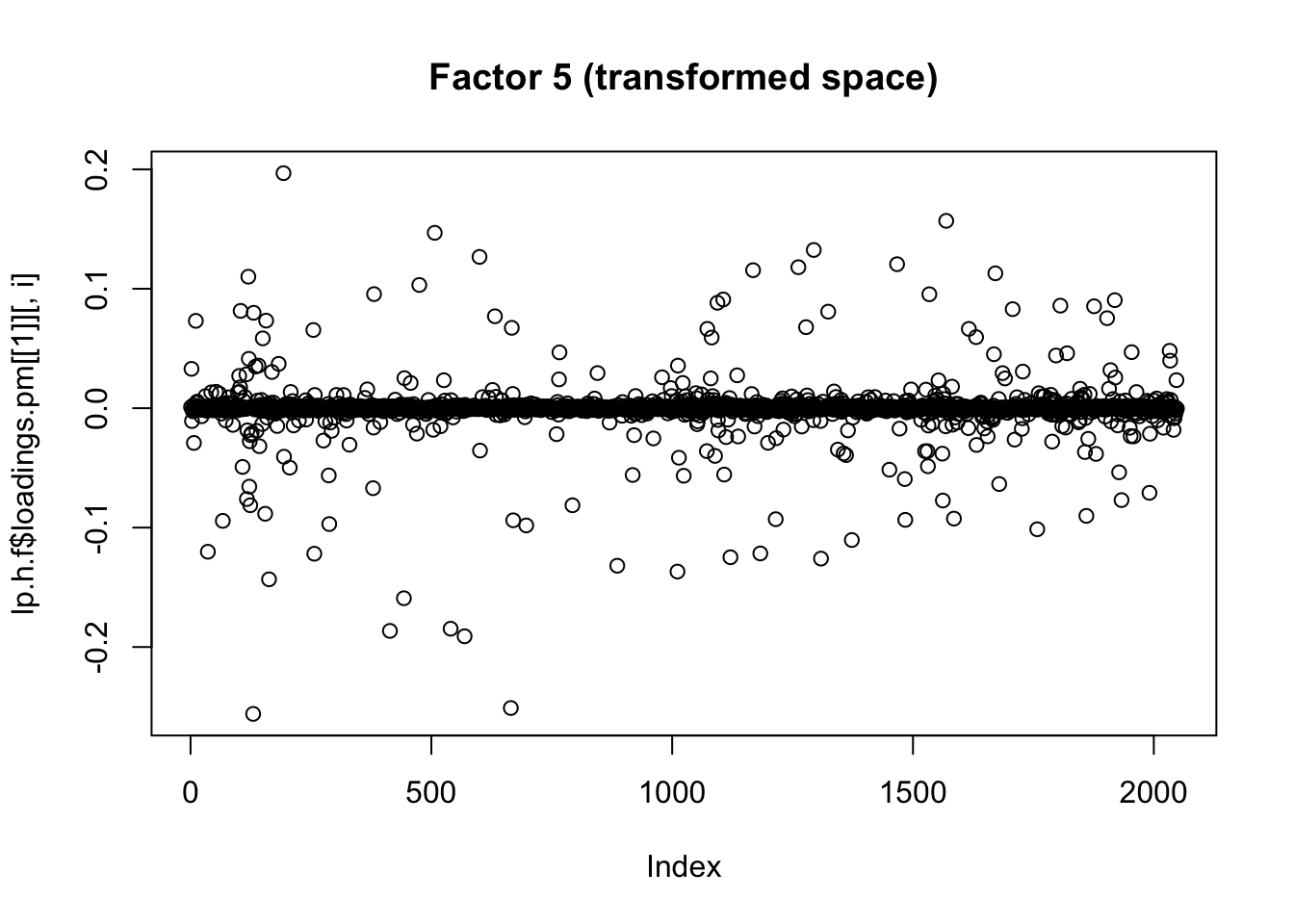

}Now I plot the above fitted factors after haar transform. As expected they are sparser in that basis.

for(i in 1:7){

plot(haar(fit.f3$loadings.pm[[1]][1:2048,i]), main=paste0("Factor ",i, " (transformed space)"))

}

Compute the haar transform of log returns:

lp.h = log_returns[1:2048,]

# do haar wavelet decomposition on log-returns and save in lp.h

for(i in 1:ncol(log_prices)){

lp.h[,i] = haar(log_returns[1:2048,i])

}Quick look at correlations of the transformed data.

S.h = cor(lp.h)

heatmap(S.h, xlab = names(prices), symm=TRUE)

Maybe it makes sense just to do the higher scales?

low_res = 2048-(0:255)

S.h = cor(lp.h[low_res,])

heatmap(S.h, xlab = names(prices), symm=TRUE)

I’m not quite sure of the right way to proceed here… I’m just going to apply flash to the wavelet transformed data, even though that does not really seem quite right (the iid prior on wavelet coefficients at different scales does not really seem sensible.)

lp.h.f = flashier::flash(lp.h)Adding factor 1 to flash object...

Adding factor 2 to flash object...

Adding factor 3 to flash object...

Adding factor 4 to flash object...

Adding factor 5 to flash object...

Adding factor 6 to flash object...

Adding factor 7 to flash object...

Adding factor 8 to flash object...

Adding factor 9 to flash object...

Factor doesn't significantly increase objective and won't be added.

Wrapping up...

Done.

Nullchecking 8 factors...

Done.for(i in 1:8){

barplot(lp.h.f$loadings.pm[[2]][,i], names.arg=names(prices), horiz=TRUE,las=2, main=paste0("Factor ",i))

}

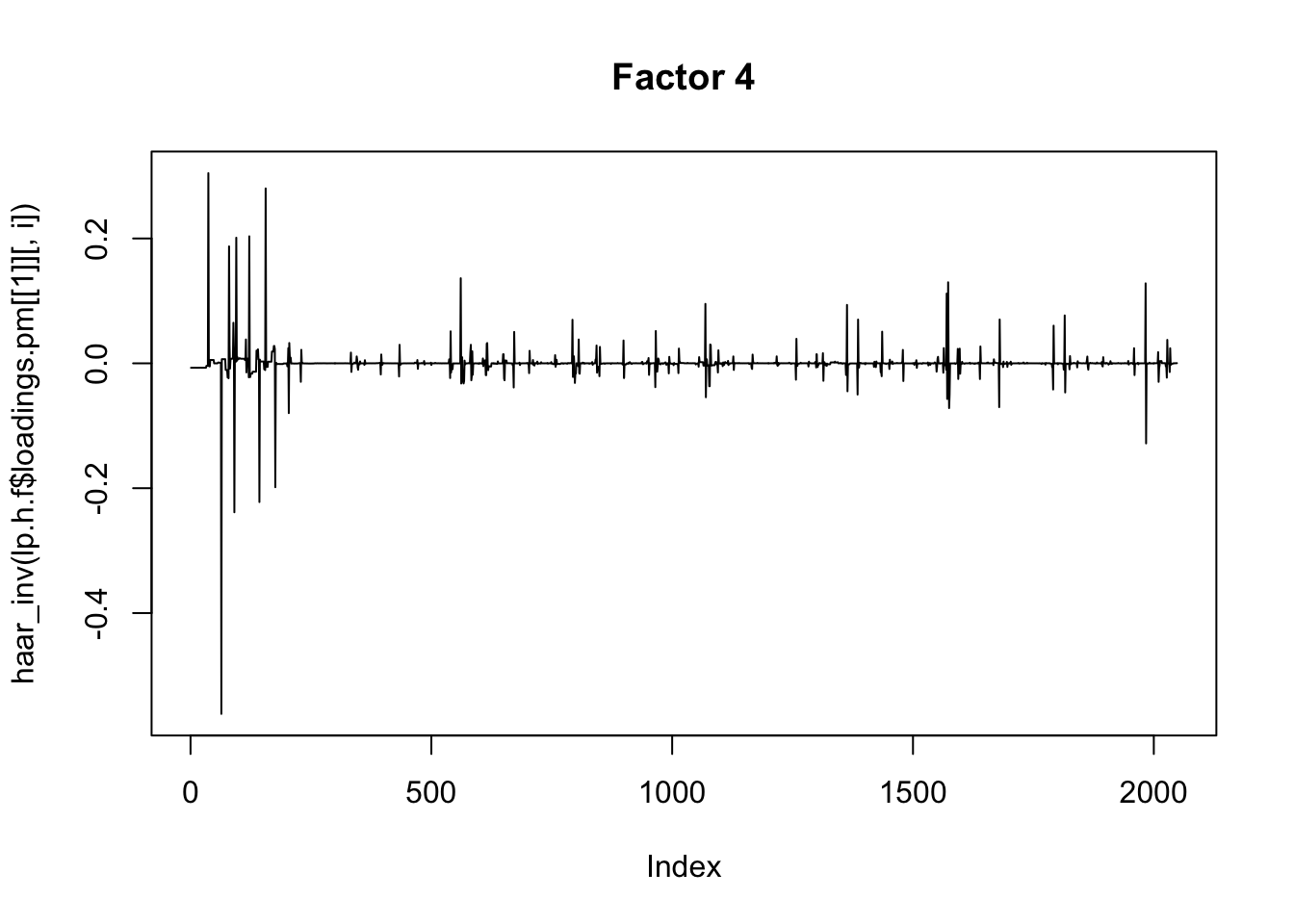

for(i in 1:8){

plot(lp.h.f$loadings.pm[[1]][,i], main=paste0("Factor ",i," (transformed space)"))

}

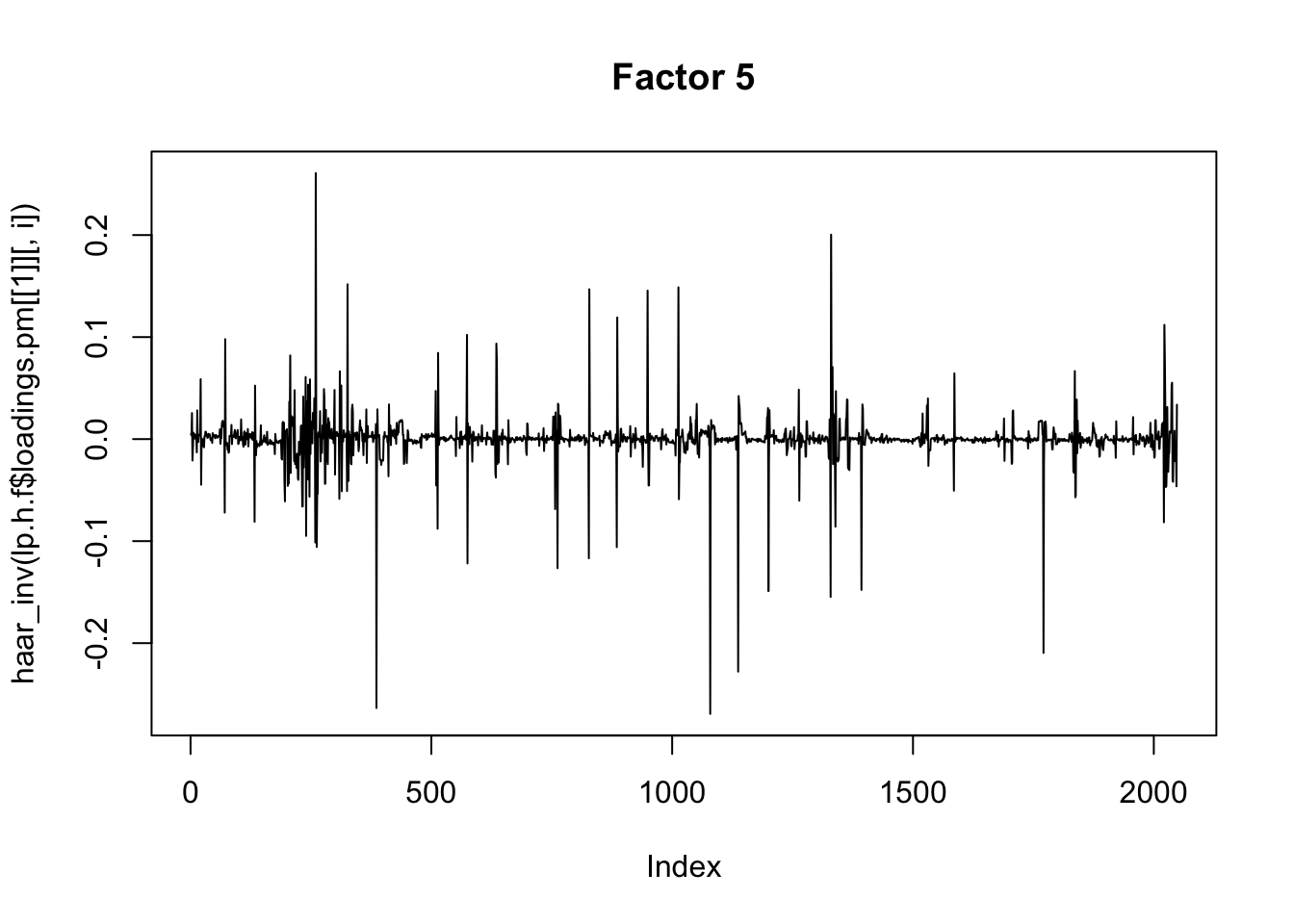

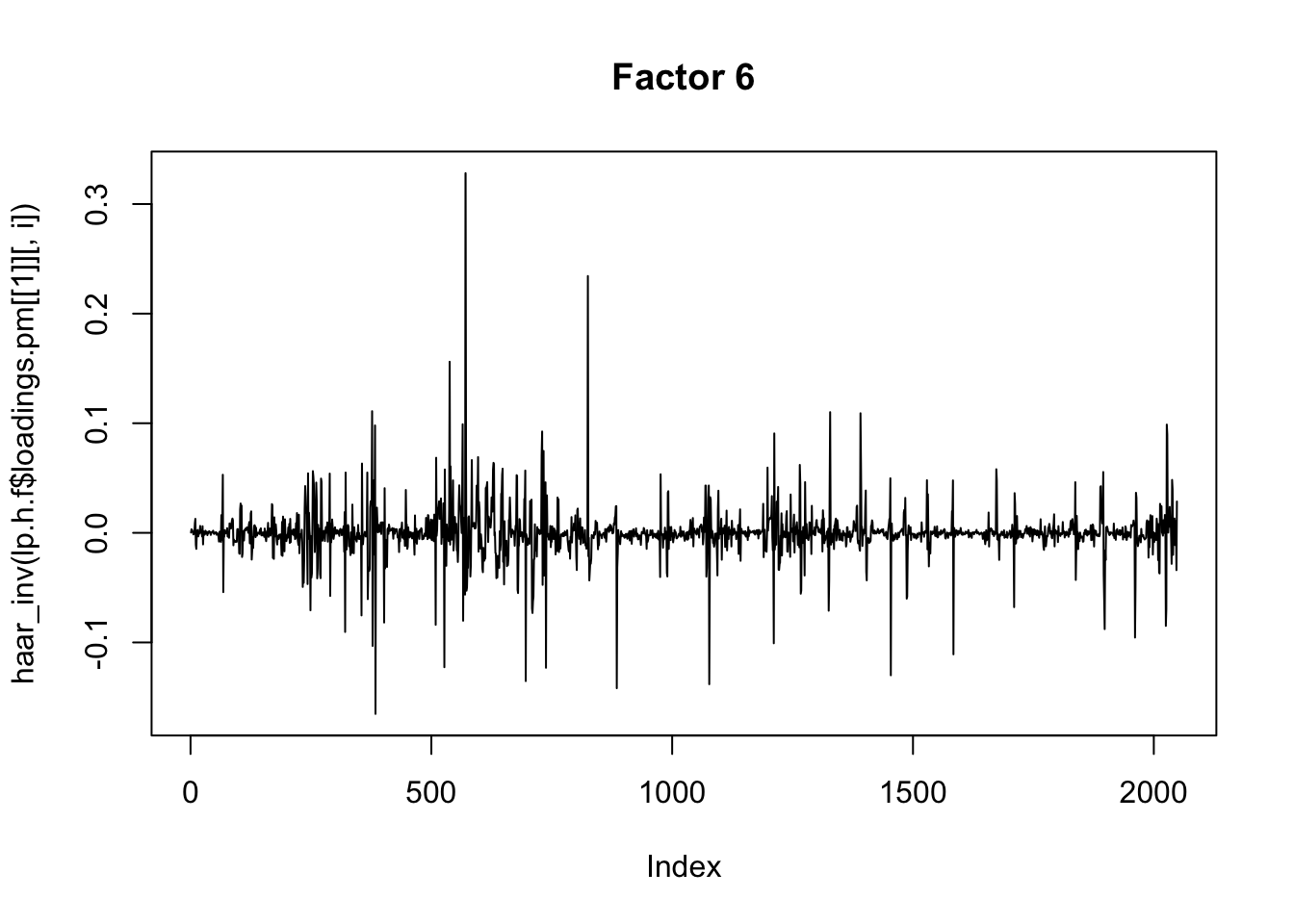

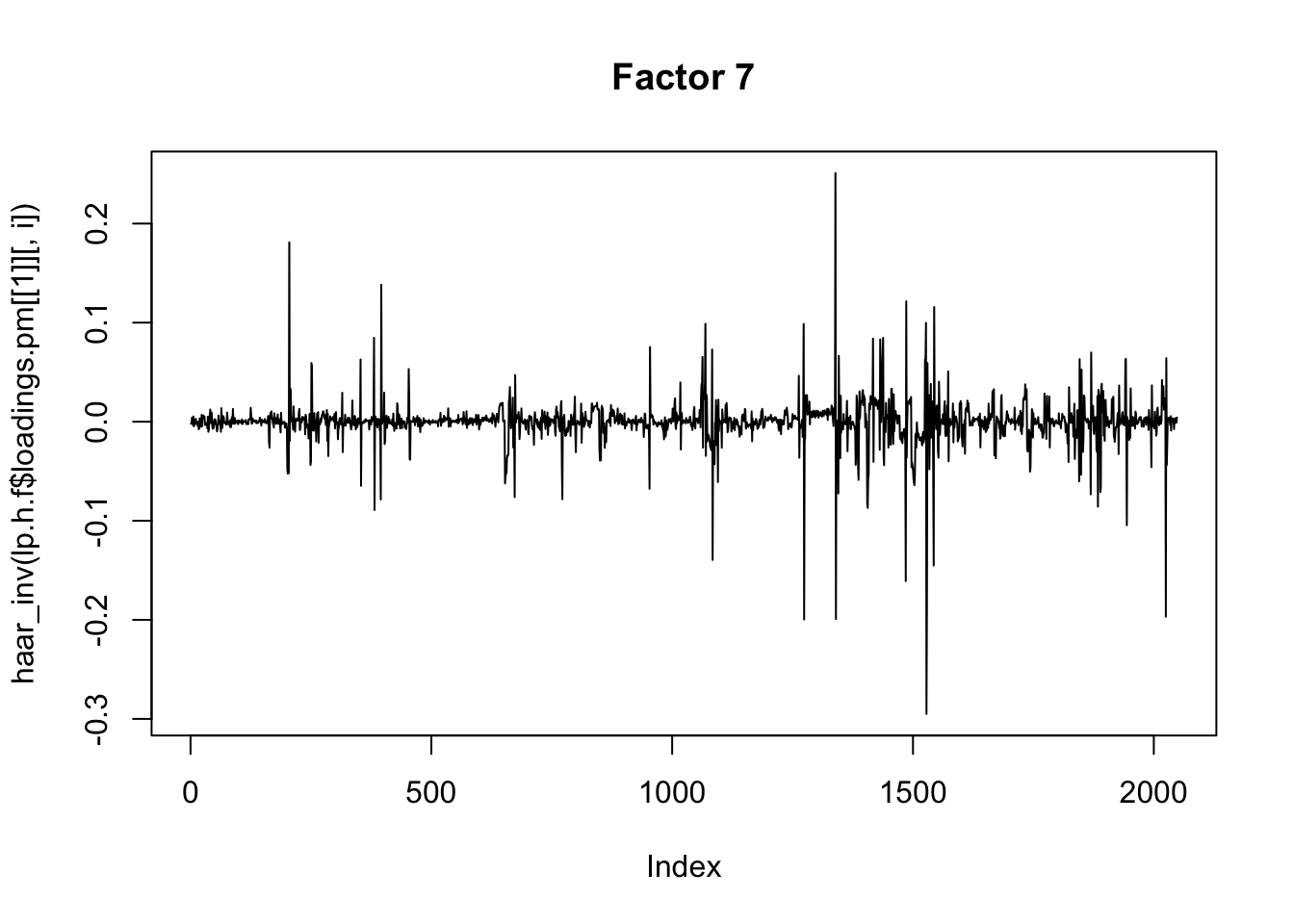

for(i in 1:8){

plot(haar_inv(lp.h.f$loadings.pm[[1]][,i]), main=paste0("Factor ",i),type="l")

}

Well this certainly made a difference: the first factors are no longer the time series type trends etc….Also they are not very spatially smooth. We may need to work on that.

sessionInfo()R version 3.6.0 (2019-04-26)

Platform: x86_64-apple-darwin15.6.0 (64-bit)

Running under: macOS 10.16

Matrix products: default

BLAS: /Library/Frameworks/R.framework/Versions/3.6/Resources/lib/libRblas.0.dylib

LAPACK: /Library/Frameworks/R.framework/Versions/3.6/Resources/lib/libRlapack.dylib

locale:

[1] en_US.UTF-8/en_US.UTF-8/en_US.UTF-8/C/en_US.UTF-8/en_US.UTF-8

attached base packages:

[1] stats graphics grDevices utils datasets methods base

other attached packages:

[1] flashier_0.2.7 ebnm_0.1-24

loaded via a namespace (and not attached):

[1] Rcpp_1.0.6 pillar_1.4.6 compiler_3.6.0 later_1.1.0.1

[5] git2r_0.27.1 workflowr_1.6.2 tools_3.6.0 digest_0.6.27

[9] evaluate_0.14 lifecycle_1.0.0 tibble_3.0.4 lattice_0.20-41

[13] pkgconfig_2.0.3 rlang_0.4.10 Matrix_1.2-18 rstudioapi_0.13

[17] parallel_3.6.0 yaml_2.2.1 xfun_0.16 invgamma_1.1

[21] stringr_1.4.0 knitr_1.29 fs_1.5.0 vctrs_0.3.8

[25] rprojroot_1.3-2 grid_3.6.0 glue_1.4.2 R6_2.4.1

[29] rmarkdown_2.3 mixsqp_0.3-43 irlba_2.3.3 ashr_2.2-51

[33] magrittr_1.5 whisker_0.4 backports_1.1.10 promises_1.1.1

[37] ellipsis_0.3.1 htmltools_0.5.0 httpuv_1.5.4 stringi_1.4.6

[41] truncnorm_1.0-8 SQUAREM_2020.3 crayon_1.3.4